If you own any real property other than your primary residence than you should have at least heard the term “1031 Exchange”. And if you invest in real estate, you undoubtedly have heard of them and probably used them. But how well do you know them, all the different rules, and the best procedures? Did you know that the 1031 is great strategy for both Retirement Planning and Estate Planning? Or that it’s a a grossly under-utilized too for real estate investors who buy fixers or new construction? Did you know that a 1031 Exchange is not a tax write-off? So what is it then? And what the heck is a “Reverse Exchange”? Read on to find out what a 1031 Exchange is, is not, and why you want to know the details about it.

“This sounds complicated, do I really need to read this stuff?” If you have any property besides your principal residence the answer is Yes, and if you have any children it’s a capital YES. Remember, wealth is not just about how much you make but about how much you KEEP. A 1031 Exchange is a similar concept to an IRA, it is a TAX system that will allow you to KEEP MORE MONEY… IF you follow the IRS Rules. But if you break the rules in any way, while you won’t be fined per se, you’ll lose your TAX SAVINGS. This is a big deal. Consider this: When you sell an investment property outright, between federal and state capital gains tax, depreciation recapture, and the possible 3.8% net investment income tax due, you may pay approximately 25-40% of your profits to the government that tax year. That’s no bueno. So let’s take a deep dive and learn about what this mysterious section of the tax code can do for you, when to use it and how you can make it happen.

What is a 1031 Exchange?

The term 1031 Exchange is defined under section 1031 of the IRS Code. It’s also sometimes referred to as a “Starker Exchange” because a family in Oregon took this federal tax provision, which was drafted in the 1920s, for a delayed real estate exchange many years later where it was challenged in the court system until they finally won in 1979. It allows a real estate investor to “defer” paying capital gains taxes on an investment property when it is sold, as long another “like-kind property” is purchased with the profit gained by the sale of the first property. With your sale structured as a 1031 Exchange, you would sell the property and typically use all of your profits to purchase new investment property within a six month period. By using all proceeds to purchase replacement property of at least equal value to the property you sold, you defer 100% of the capital gains tax and other taxes otherwise due. That means you keep all of your equity working for you, with the income generated being far higher than any savings account earnings.

For example, perhaps you own a single family residence (SFR) in Los Angeles and are sick and tired of the City Rent Control, County Rent Control and (now) the California State Rent control provisions. You heard Rock Real Estate talk about how you can sell your California SFR for $1M and buy three for four SFRs in Orlando, Florida to rent out monthly or even nightly to DisneyWorld tourists. You want to sell your California property and buy properties in Florida, but you don’t want to pay Uncle Sam 40% of your profit on the $1M sale, which is a substantial amount of money. So, you hire a qualified “intermediary” to structure the transaction a certain way to avoid paying the significant capital gains taxes that year and you get the sale and subsequent purchase or replacement property(s) done in a short amount of time.

What they don’t tell you about 1031 Exchanges – the Good and the Bad

Now I hate to be the bearer of bad news, but keep in mind this is a deferral, not a write-off. If you eventually “cash out” during your lifetime then you will have to pay those huge capital gains taxes.

On the plus side, you can keep deferring for the rest of your life… but then what happens when you’re time here is finally up?

Well it’s a good thing that I’m also an Estate Planning attorney because I’ve got good news! The 1031 Exchange is also a great Estate Planning tool. It’s been said that “the only thing for certain is death and taxes”… but here the tax part is not certain! If you are holding investment property that had been part of a 1031 Exchange, upon your death, your heirs get a “Stepped-Up Basis”. All of that built-in gain disappears upon your death, so the value of the property at the date of your death would pass through your estate to your heirs. If they decide to sell the property for that same appraised value, there would be NO capital gains tax due to be paid by your heirs. What better way to help the future of your heirs?

Here’s an example: You own a rental property you bought years ago for $350,000. Rather than hold the one property you know your three children will be fighting over, you decide to sell it for $1.5M as part of a 1031 Exchange. The capital gain tax would be enormous otherwise. After consulting with each of your children to see what kind of property each would like, you acquire three separate replacement properties, each worth $500,000. Working with an estate planning attorney, each property could be placed into its own revocable living trust with one child being named as the beneficiary of each trust. When you pass away, the properties will automatically transfer to that child, free of taxes and with a stepped up basis equal to the value of the property at the time of death. That’s muy bueno.

A Strategy for Seniors

If you’re contemplating retirement, you might want to purchase a Replacement Property in an area you plan to retire in, to give you (1) the comfort of getting to know the local community, (2) continued cashflow income while owning the investment, and (3) the option in a few years for you to convert the property use from investment to personal. At that time it could become a second home for you, family and friends to visit or even your primary residence in retirement.

Here’s how you do this within the “Safe Harbor.” For two years after the exchange, you must:

(a) Rent the property at fair market rent (FMR) – BTW you may rent it to a family member if they pay FMR and it is their primary residence – for at least 14 days each year; AND

(b) Use the property for personal purposes no more than 14 days each year or 10% of the actual period it is rented out each year (whichever is greater)

Details can be found in Revenue Procedure 2008-16. Keep in mind that investments of vacation properties or second homes that do not follow the safe harbor guidelines provided within Revenue Procedure may still qualify for tax-deferred treatment. Incredible huh? BUT it is imperative that investors consult with their tax and legal advisors to determine whether their real property qualifies for 1031 Exchange treatment. Each case is different and individual factors, intent and proof to support tax-deferred treatment must all be considered.

In addition, these laws are subject to change. President Biden has stated that his administration will consider eliminating 1031 Exchanges entirely, so who knows? More likely there will be modifications made to the rules, and I wouldn’t be surprised if the rules I describe here are modified by the time you read this. Remember this is to educate you about the concepts, this is not legal advice. Always consult professionals when contemplating a 1031 Exchange.

When to do a 1031 Exchange?

If you want to sell a rental property that is worth significantly more today than what you (or the original owner) purchased it for this is a great tool to use. Unless your property is falling into the ocean or a prison was built next door, this is EVERY property that has been own for a significant length of time.

When a property is sold, capital gains taxes are calculated based on the property’s net-adjusted basis, which reflects the property’s original purchase price, plus capital improvements minus depreciation.

Depreciation is the percentage of the cost of an investment property that is written off every year, recognizing the effects of wear and tear. If a property sells for more than its depreciated value, you may have to recapture the depreciation (prior write off). That means the amount of depreciation will be included in your taxable income from the sale of the property. Since the size of the depreciation recaptured increases with time, you may be motivated to engage in a 1031 Exchange to avoid the large increase in taxable income that depreciation recapture would cause later on. Talk to your tax advisor about this.

1031 Exchange Basics

To use this strategy for its fullest benefit, both the purchase price and the new loan amount must be the same or higher on the replacement property or properties than the property you’re selling.

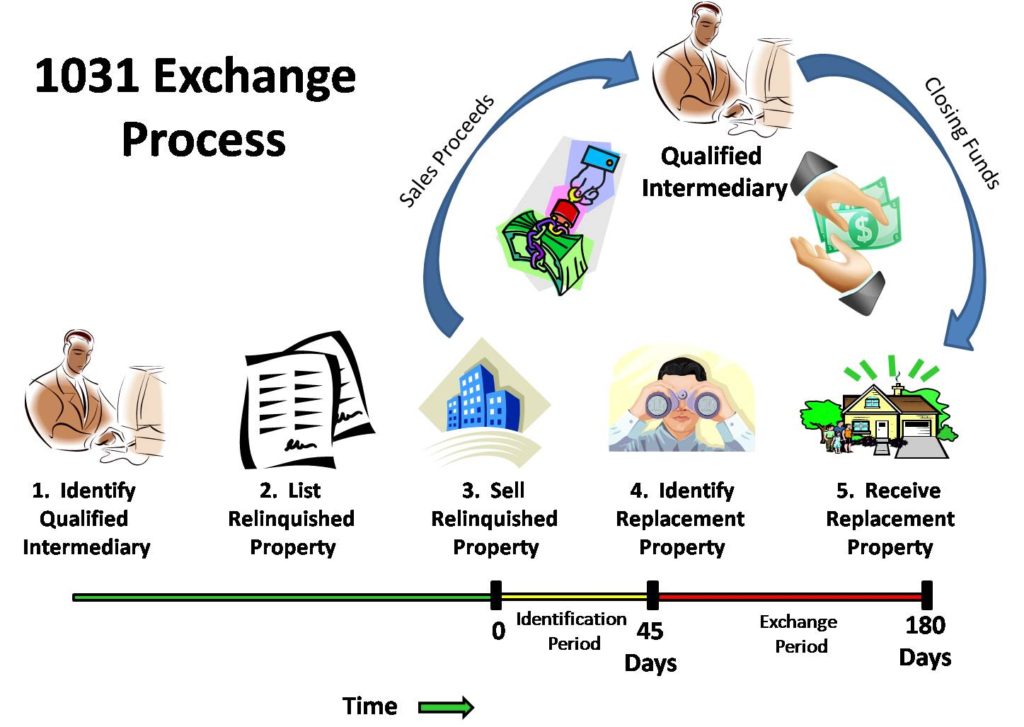

Proceeds from the sale must be transferred to a qualified intermediary, rather than to the seller of the property, and the qualified intermediary transfers these funds when needed for the purchase(s). A qualified intermediary is a person or company that agrees to facilitate the 1031 exchange by holding the funds involved in the transaction until they can be transferred to the seller of the replacement property. The qualified intermediary can have no other formal relationship with the parties exchanging property.

What are the types of 1031 Exchanges used by Real Estate Investors?

The most common like-kind exchange types include the simultaneous, delayed, reverse, and construction/ improvement exchange.

(1) A SIMULTANEOUS EXCHANGE occurs when the replacement property and relinquished property close on the same day. This was the original exchange that the 1920’s-era law contemplated. This is for pros only! There are three basic ways that a simultaneous exchange can occur.

- Swap, whereby the two parties exchange or “swap” deeds.

- Three-party exchange where an “accommodating party” is used to facilitate the transaction in a simultaneous fashion for the exchanger.

- Simultaneous exchange with a qualified intermediary who structures the entire exchange.

(2) The DELAYED LIKE-KIND EXCHANGE, which is by far the most common type of exchange, occurs when the exchangor relinquishes the original property before he acquires replacement property. (Refer to the illustration above.) The Exchangor is responsible for marketing his property, securing a buyer, and executing a sale and purchase agreement before the delayed exchange can be initiated. Once this has occurred, the Exchangor must hire a third-party Exchange Intermediary to initiate the sale of the relinquished property and hold the proceeds from the sale in a binding trust for up to 180 days while the seller acquires a like-kind property. an investor has a maximum of 45 days to identify the replacement property and 180 days to complete the sale of their property.

1031 exchanges carried out within 180 days are commonly referred to as delayed exchanges, since, at one time (prior to the Starker family’s legal battle), exchanges had to be performed simultaneously.

(3) A REVERSE EXCHANGE, also known as a Forward Exchange, occurs when you acquire a replacement property through an exchange accommodation titleholder before you identify the property to be sold. This type requires all cash. In this case, the replacement property must be transferred to an exchange accommodation titleholder (which can be the qualified intermediary). Within 45 days of the transfer of the property, a property for exchange (to be sold) must be identified, and taxpayers then have 135 days to complete the sale of the relinquished property and close out the reverse 1031 exchange with the purchase of the replacement property. A failure to close on the relinquished property during the established 180 day “parking” period for the acquired property will result in a forfeit of the exchange. This is another one I’d leave to the pros.

(4) The CONSTRUCTION/IMPROVEMENT (“BUILD TO SUIT”) Exchange allows the replacement property in a 1031 exchange to be renovated or newly constructed. It uses tax-deferred dollars to enhance the replacement property while it is placed in the hands of a qualified intermediary for the remainder of the 180 day period. This is a great tool that many real estate investors fail to take advantage of. However, these types of exchanges are still subject to the 180-day time rule, so any improvements made afterward are considered personal property and won’t qualify as part of the exchange.

More 1031 Exchange Rules

So now we’ve covered the basics, and we’ve assumed that you the investor want to take FULL advantage of the 1031 Exchanged tax deferment. But what about “Downsizers” for example, or those that want or need to take some cash out of sale for various reasons?

BOOT –The difference in value between a property and the one being exchanged is called boot. If a replacement property is of lesser value than the property sold, the difference (cash boot) is taxable. If personal property or non-like-kind property is used to complete the transaction, it is also boot, but it does not disqualify for a 1031 exchange.

MORTGAGES — The presence of a mortgage is permissible on either side of the exchange. If the mortgage on the replacement is less than the mortgage on the property being sold, the difference is treated like cash boot.

EXPENSES — The following expenses can be paid with exchange funds. These include:

●Broker’s commission

●Qualified intermediary fees

●Filing fees

●Related attorney’s fees

●Title insurance premiums

●Related tax adviser fees

●Finder fees

●Escrow fees

Expenses that cannot be paid with exchange funds include:

●Financing fees

●Property taxes

●Repair or maintenance costs

●Insurance premiums

BUSINESS ENTITIES — LLCs can only exchange property as an entity, unless they do a drop and swap, in case some partners want to make an exchange and others do not. Interest in a partnership cannot be used in a 1031 exchange—partners in an LLC do not own property, they own interest in a property-owning entity, which is the taxpayer for the property. 1031 exchanges are carried out by a single taxpayer as one side of the transaction. When one partner wants to make a 1031 exchange and the others do not, that partner can transfer his partnership interest to the LLC in exchange for a deed to an equivalent percentage of the property. Note: a single-member LLC is a “disregarded entity” for federal tax purposes.

Seven Rules to Remember

Rule 1: Investment or Business Property

The 1031 is only applicable for Investment or business property, so you cannot use a residence in either side of a 1031-Exchange.

Rule 2: Same Tax Payer

The tax return name and the name appearing on the title of the property being sold must be the same as the taxpayer and title holder that buys the new property. However, an exception to this rule occurs in the case of a single member limited liability company (“SMLLC”), which is considered a pass-through to the single member.

Rule 3: 45 Day Identification Window

The property owner has 45 calendar days, post-closing of the first property, to identify up to three potential properties of like-kind. There are two exceptions:

- One exception is known as The 200% Rule. In this situation, you can identify four or more properties as long as the value of those four combined does not exceed 200% of the value of the property sold.

- The 95% Rule allows you to identify as many properties as you like as long as you acquire properties valued at 95% of their total or more.

Rule 4: 180 Day Purchase Window

It’s necessary that the replacement property be received and the exchange completed no later than 180 days after the sale of the exchanged property OR the due date of the income tax return (with extensions) for the tax year in which the relinquished property was sold, whichever is earlier.

Rule 5: Greater or Equal Value

The IRS requires the net market value and equity of the property purchased must be the same as, or greater than the property sold.

Rule 6: Must Not Receive “Boot”

A partial 1031 exchange, in which the new property is of lesser value, will not be 100% tax free. The difference is called “Boot,” which is the amount you will have to pay capital gains taxes on. Any boot received is taxable to the extent of gain realized on the exchange. A partial exhange is done when a seller wants to make some cash, and is willing to pay some taxes to do so.

Rule 7: Like-Kind Property

Like-Kind property is a very broad term which means that both the original and replacement properties must be of “the same nature or character, even if they differ in grade or quality.” In terms of real estate, you can exchange almost any type of property. It’s important to note that the original and replacement property must be within the U.S. to qualify under section 1031.

EXCEPTION: Starker Exchanges can include more than two properties. For example, you can exchange one property for multiple replacement properties and vice versa: you can exchange multiple properties and for one larger property. This is a great way to increase cash flow. For example, sell one expensive property in California and buy several in Florida or Texas.

Like-kind property is broadly defined according to its nature or characteristics (i.e. “Real Property”), not its quality or grade. This means that there is a broad range of exchangeable real properties. Vacant land can be exchanged for a commercial building, for example, or industrial property can be exchanged for residential. The property must be held for investment though, not resale or personal use, which usually implies a minimum of two years’ ownership.

Summary

The biggest advantage of using this strategy is that you can defer if not avoid having to pay capital gains taxes on the sale of an investment property. This can be a huge benefit for real estate investors who know which markets are primed to grow next. It could also be bad news for beginning investors who sell now without being ready or having done enough research as you risk falling victim to a reduced basis for depreciation on the replacement property. It’s important that you choose your replacement property (or properties) wisely, investing in a market that has good potential for growth in the future.

At it’s core, a 1031 Exchange is executed for one reason: to defer taxes. But It can do so much more than this, especially for Californians. Real Estate investors can leverage their tax-savings to invest in multiple properties that will (a) generate more cash flow every month, (b) take less time to manage, and (c) give them more freedom. I have heard of people that have purchased as many as TWENTY properties from selling one Southern California property, and are 10x-ing their ROI and cashflow. And don’t forget what I said about using the 1031 Exchange in your Estate Planning and Retirement Planning strategies. You’ll thank yourself soon enough and your kids will thank you later.

If you’re a property owner and you thought THIS was exciting, wait until you see our future article and video about using Delaware Statutory Trust (DST) Real Estate in your next 1031-Exchange!

Recent Comments