So you’re a Buy & Hold Landlord in California, struggling to stay profitable while your non-paying tenants feel safe know that you cannot evict them, and even when you can, you probably will need to pay five-digit relocation payments to the tenant who hasn’t paid you in two years. Wanna get away? Maybe selling your California Properties right now as the market is peaking and trading them in for 2-4 times the number of Units in Orlando with a 1031-Exchange is the right solution for you. Rock Real Estate has set up a “Investor Train To Orlando” and we invite you to jump aboard, the destination promises higher profits and less headaches. We have the team in here and in Florida to make it happen.

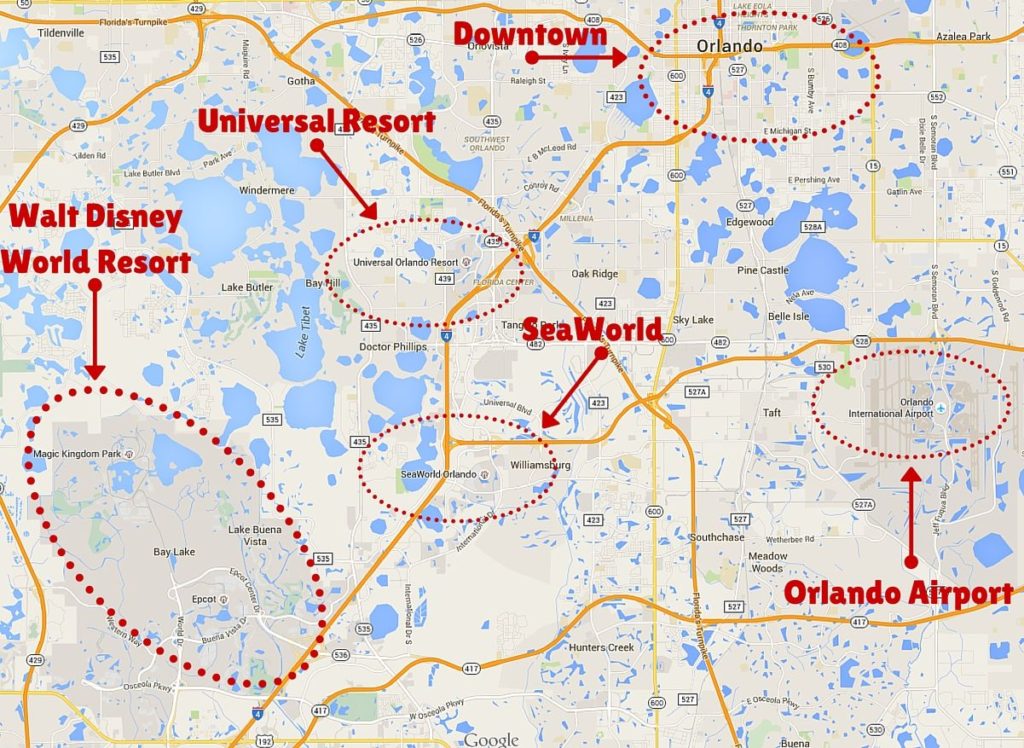

Orlando as an Investment Destination

While some people think of Orlando is just a tourist town, Orlando is busy leading the nation in job growth and higher education. As home to the nation’s largest university and one of the fastest growing economies, there’s probably a lot more you don’t know about Orlando. Maybe it’s time to change that. Forbes rated Orlando the #1 Best City to invest in housing for 2018, and the accolades keep coming.

Why? For one thing, buying rental property in certain areas of greater Orlando give investors the option of renting to families by the month, OR have year-round short-term rentals to 10x your ROI – after all, DisneyWorld is consistently the largest tourist destination in all of the United States! We have found our clients 100% Turn-Key Short-Term Rentals fully booked ahead for months in Condo and Townhome communities that actually cater to the AirBnB crowd with game arcades, pool tables, jacuzzis, gyms, ping-pong tables, tennis courts, pools with water slides. All you need to do is tell the property manager that you’re the new owner, assign the AirBnB account and receive the income!

THE FUNDAMENTALS

Jobs – Sunshine – No State Income Tax – Affordable Housing (currently)

Florida has been growing at a healthy pace for years – from 2010 – 2017 the state has grew at a rate of 7.8%, almost double the national average – but the Covid pandemic and growth of the work-from-home society has turned Florida into a boom state. Think about it, if you are now able to work from home and you’re currently fighting ice storms and blizzards in Detroit, New York City, Chicago, Dc, Pittsburgh, Minneapolis or Buffalo, why wouldn’t you move to a place that never freezes and has year-round outdoor recreation? And for Real Estate investing, Orlando not only has a strong economy – the tourism industry centered around Disney, Sea World and Universal is augmented by a diverse array of solid industries – but some of the most under-valued housing prices. That means there is plenty of room for your property value and rental income to increase, all built on a strong economic base that should ensure continued growth.

Bullet Points

- Affordable: In January 2022, the median listing home price in Orlando, FL was $330K, trending up 15.8% year-over-year. The median listing home price per square foot was $205. The median home sold price was $329K.

- Florida is a landlord-friendly state compare to most, certainly much more favorable to investors than California. On average, an eviction process takes about 15 days if there are no valid defenses to the eviction action. An eviction occurs when a tenant has breached the terms of the tenancy in some material way, or has refused to move out once the rental agreement has expired.

- Oh, did we mention that Florida has No Rent Control laws – Unlike California, Florida is a state that puts the needs and requests of the landlord before that of the tenant. Fortunebuilders rates Florida as #3 in the nation for both 2021 and 2022.

- Low Property taxes and Insurance.

- Great tenants! Central Florida is still one of the most desired places in the country for retirees – many of whom opt to rent their housing as versus making a high-ticket purchase of a new home.

- How profitable are Airbnb vacation home rentals in greater Orlando? According to AirDNA and Mashvisor, the answer is very profitable. Currently (March 2022) the average Nightly Rate for the areas we invest in is $265, the Occupancy Rate is 70% and the Monthly Income is $3,811. (Remember, the average home costs $330K.) To learn about a top investment property calculator, click here or click here for a free one.

Related: Buying Rental Property Calculator: The First Thing to Do in Real Estate Investing

- Florida is a judicial foreclosure state, which means that the fallout from “the Great Recession of 2018” is lagging behind the rest of the county, as judicial foreclosures are still being processed; this kept Florida housing prices “artificially low” for a long time.

- One of only seven states without a state income tax, many seek to establish sunny Florida as their residence of choice. Combine that with sunny weather and relatively low prices, people across the country are flocking to Central Florida to work or retire, and that means properties are very likely to appreciate in a big way.

NO State Property Tax

No. 1 in the Country for Job Growth – U.S. Dept. of Labor, Bureau of Labor Statistics, 2015-2018

No. 2 Best State for Business – Chief Executive Magazine, 2021

No. 4 Best Market in U.S. for Development Opportunities — CBRE, 2021. More than just a tourism town — 80 percent of Orlando’s workforce is employed in an industry outside of leisure and hospitality. There are more big names in town than just the ones you’d expect.

Unemployment statistics for Florida hover near the number that is considered “fully employed” – at 3.7%. Extraordinarily, Orlando is even better than that at 3.2%, which has caused an increase in wages, permitting higher home and rental prices to be absorbed without diminishing demand.

Unemployment has dipped to 3.4%, while the National Average is 4.4%.

41% population growth since 2000. In 2015 alone, the region had about 9,778 new housing starts… yet more than 50,000 new residents were added. The supply cannot keep up with demand.

Median price of single family homes in Orlando Market increased by more than 12% in 2016 and another 10% in 2017. That was well before the Covid-led price appreciation. Forbes predicts 35% appreciation in the next three years!

That means your property gains value… and less people can afford to buy, so more people are forced to rent, which means rental rates continue to increase.

Appreciation + Tax Deductions + Rent = WIN WIN WIN!

A SUNNY OUTLOOK FOR GREATER ORLANDO

- Forbes named Orlando the #1 Best US City to Invest in Housing for 2018.

- The University of Central Florida is the nation’s second largest educational institutions in the country with over 60,000 students.

- Housing inventory fell 11% in 2017, with SFR inventory down to only 2.3 months (four months is considered “balanced”.

- As a result, occupancy rates are as high as 96.9%.

- The median housing price rose 10% from April 2017 to April 2018.

- The 2017 Milken Institute Best-Performing Cities Index rated Orlando #7 in the USA for 2017, and Orlando continues to rise in the rankings.

- Recently named the “hottest” single-family real estate market among the 50 largest US metro areas.

- Industry leader CoreLogic rated Orlando #2 on its list of SFR price growth across the 20 US metros it tracks, with a 5.4% rental price growth.

- The $2.3 Billion I-4 Ultimate Project is remapping 21 miles of interstate 4 from downtown Orlando to the suburbs north and south, so you can expect purchase and rental prices in the ‘burbs to increase. A two-bedroom apartment in the city now averages $1228 per month.

- Rents spiked an impressive 7.0% in 2017.

- The most visited tourist destination in the country, with 60 million visitors in 2015.

- Orlando Medical City boasts $7.6 billion economic impact & will create 30,000 jobs.

- Amazon Fulfillment recently opened, bringing 4,000 jobs to Central Florida.

- The health services industry continues to expand, adding thousands of new highly skilled jobs.

- Employment grew by 3.5%, and rents increased by 3.4% this year, which is higher than the national and state levels.

- More jobs means more money means RENTS AND PROPERTY VALUES WILL CONTINUE TO RISE

COMPARE TO CALIFORNIA

The Covid Pandemic exposed the underlying politics and policies of each of the 50 states. California is clearly one of the most tenant-friend states in the union, and Los Angeles County in particular can lay claim to the dubious distinction of being the most unfriendly places for Landlords in the Country. While California Landlords are still under an eviction moratorium, Florida has been back to normal for a long time and masks are a thing of the past (with no adverse health consequences.)

One of the best indicators of the health of the housing market is the “Composite Housing Affordability Index”, which compares and contrasts the ability of the median income household to qualify for the median priced house in its area. Only 31% of households in the entire state of California could afford the $538,000 median priced home as of March 2018, but as if that’s not bad enough, several metro counties have prices so high that only 15% of households could afford the median priced home (Stats: California Association of Realtors). Remarkably, even after the price rises seen in the past few years, the index is still strong in Greater Orlando, with the median earnings providing over 26% more earnings than needed to support a mortgage on the median priced home (stats: Orlando Regional Realtor Association).

What this means is, there is still plenty of room for prices to increase in Orlando, compared to California, where the indicators show a high possibility that housing prices are in a bubble… and bubbles burst. In short, Orlando is a fundamently sound place to invest in real estate.

GREAT OPPORTUNITIES

- Attractively priced distressed properties

- Single family homes from $100K

- Strong rents starting at $900 per month

- Motivated sellers in good neighborhoods

- Properties well below rebuild costs

WHY INVEST IN ORLANDO

- An attractive place to live that is still well under-valued

- Right-priced deals where the numbers really make sense

- Above average yields

- Steady cash flow

- Wealth building potential through growing equity

- Sustainability in returns

- FOR MORE INFO — https://business.orlando.org/l/resource-center/

- BOTTOM LINE – A pricier and sunnier alternative to Cleveland and Detroit.

INTERESTED IN INVESTING IN ORLANDO?

Get in touch right now to find out about current opportunities, and have all your questions answered by a professional investor. You don’t want to procrastinate on this one, prices are rising every day… Opportunity is knocking, it’s time to answer!

Recent Comments