What can I say, when writing a 2020 “Year In Review” I could easily write 500 pages. I thought 9/11 was bad, but I can’t remember any year where the way we live our day-to-lives was so drastically altered. Looking back on February, everything was roses, the economy was booming and the future seemed unlimited. For me it all “got real” when the NBA cancelled basketball games on Wednesday March 11 and next day put the NBA season “on hold.” That seemed unthinkable to me at the time. Back then we thought the heat of Summer would kill the virus, and I remember driving through Old Town Temecula on Memorial Day being shocked to see crowds of partygoers none of whom were wearing masks. I guess we all wanted to “speak the cure into existence.” Nobody believed that as 2020 ended, we’d be talking about “the worst is yet to come” but that’s where we are on this last day of 2020 with the beginning of “the holiday season rebound” and fears of “super-spreader holiday parties.” Nobody saw THIS coming, that’s for sure. Fortunately, the vaccine is on its way and things should be back to “normal” – whatever that will be – by the Summer… right?

So what about the Housing Market? With the economy taking massive hits with entire industries – such as live entertainment, movie theaters, concert venues, nightclubs and bars, indoor dining establishments, gyms – on the brink of collapse, nobody saw THIS coming either: One of the strongest* housing markets in a long time! Say what?! How!? (*BTW “Strongest” is a Real Estate Industry term meaning, basically, a Seller’s Market – homes selling in a short time for high prices.)

Here’s an explanation of our local SoCal Housing Market off the top of my head, and then I’ll follow with some stats before wrapping up with some predictions for 2021. By the way, I delve into this in more detail and give dozens of home-selling tips in my just-published book, Buying and Selling Homes in Today’s Market, which you can read for free by clicking here.

First off, the “How!?” is that because many families were naturally concerned about putting their home up for sale with strangers coming into the home, not to mention going out and entering other strangers’ homes to find their next home, plus concern over the economy and whether their jobs were safe, the number of folks who were comfortable moving was very low. That means a low supply. In fact, currently there is only a 1.9 month supply of homes in the state, the lowest inventory in over 16 years, according to the California Association of Realtors (“CAR”). Home Listings in Ventura and San Bernardino Counties were down a whopping 50% from a year ago, says Realtor.com

Second, interest rates have surprisingly continued to decline in 2020 even after they were at near-record-low rates before the Pandemic hit. With interest rates now absurdly low – actually lower than the historic rate of inflation, which means the bank will be paying you over time – naturally folks wanted to buy. They also knew that the lower rates meant they could (1) buy the same sized home for a lower monthly payment, or (2) buy a larger home for the same monthly payment. That means high demand. So the Law of Supply & Demand says that prices will rise… and rise they did!

Here are the latest stats (remember December isn’t over yet, so we have November stats) from the California Association of Realtors (CAR). As you might expect, prices rose the most for the year in the counties where homes were the least expensive (20.7% in San Bernardino Co., 15.3% in Riverside Co.) and the least in the most expensive counties (11.7% in LA County and 13.1% in The OC.) But what you wouldn’t expect with such a small inventory is that the number of sales overall rose significantly as well, with Ventura County sales increasing by a whopping 40% compared to November 2019. So while the inventory of homes for sale was near record lows, an incredibly high percentage of them sold. Which actually makes sense, as the “DOM” (days on the market) for homes is at record lows, at only 9.0 Days Median Time on Market in California, an all-time record according to CAR. And November is typically a fairly slow month, while November 2020 was hot due to sellers finally entering the market after staying out all Summer. (Note: October was even hotter.)

Downsizing. Let’s add a couple more wrinkles to the market: Size and Geography. Due to the uncertainty of the jobs situation, and some members of the house losing their jobs – especially hit hard are teens, who once worked in Shopping Malls and Movie Theaters – families are “Downsizing” by moving to smaller homes. As you’ve probably heard, many are “downsizing” right out of the state of California! But what you might not have heard as much is that many families are Downsizing within the state and even within Southern California… to “Pandemic Destinations”. According to a Summer ‘20 Realtor.com report, 51 percent of home searches by urban residents in the 100 largest metro areas during the second quarter were for suburban properties near “Pandemic Destinations.” How does this work? Well let’s take a place like Temecula. You can get a 5 bedroom 3 bath home like this (see image) right now for $500,000 in Temecula, which would probably set you back over $1M in LA or Orange Counties.

So that’s one half to two-thirds the price for a home in the OC. Not to mention, Temecula has some of the top-rated public schools in the state, great dining and entertainment (Old Town is jumping, Pechanga Casino has slots, plenty of golf courses, and oh yeah how about 30 wineries)… so what gives? Well, in the OLD World – pre-March 2020 that is – a place like Temecula was considered “too far away from the jobs” with commute times to the OC, San Diego or the IE being well over an hour each way. But what about now? If 2020 taught us anything, it taught us that with today’s technology, many desk jobs can easily be done from home. (And BTW this might be the biggest benefit of the Pandemic – it solved many of our pressing transit issues! Think of the benefits of eliminating those commutes – less stress, less pollution, less traffic and gridlock, relieving our Freeway System which was on the brink of 7-day-gridlock, and 10-15 more hours per week of FREE TIME!)

So what does that mean for Residential Real Estate? The distance from the traditional job centers no longer matters for more people, and these work-from-home folks are looking for larger houses with room for a home office or two. And guess what, places like Temecula have larger homes – 2600 sq ft is typical – and most of the homes have been built in the 21st Century, meaning they do have office space, media rooms, and fiber optic cable and hi-speed internet. Many have Smart Technologies, which 40% of homebuyers are looking for according to a recent survey. And even better, there is no reason that prices in “Pandemic Destinations” – which have been much lower in price due to their commute distance – won’t continue to appreciate like crazy as “the virtual workforce” continues to evolve and grow.

It’s a migration folks! The stats are backing up this modern-day migration: Here are the ‘Active Listing’ stats for November 2020, courtesy of Realtor.com:

- Suburbs on the IE = Riverside-San Bernardino-Ontario, 6,707 Listings, down 55% from 2019.

- Suburbs of Ventura County = Thousand Oaks-Oxnard-Ventura 867 Listings, down 50% from 2019.

- The City = Los Angeles-Long Beach-Anaheim, 17,165 listings, down 19% Year over Year.

As you can see, a much higher percentage of suburbanites are happy just where they are. That means there are fewer homes for the cityfolk to move into, driving up prices more in these suburban/rural areas.

So to sum up the SoCal Residential Real Estate Market in 2020, if you are now able to work from home, you might just want to expand your geographic area. Besides classic “too-far suburbs” like Temecula, Camarillo, Murrieta, Santa Clarita, Palmdale, Lake Elsinore and Oxnard many folks are moving to even more remote locations like Palm Springs and Big Bear. CAR reports that California communities seeing the strongest demand are Mammoth Lakes (up 400% from 2019!), South Lake Tahoe (up 81.4 %), Big Bear (+73.9%) and Lake Arrowhead (+58.1%). In terms of price growth year over year, Big Bear prices zoomed a whopping 40.8%, and Lake Arrowhead rose 32 %.

As I discuss in my book, there are many things that Sellers and Buyers can do to prepare for that move. In this Strong* Market, Buyers definitely need to get their financial ducks in a row. If you’re thinking of moving, you should be talking to at least one mortgage broker and getting pre-qualified right now. And remember, although rates are at all-time lows, it is not easy to qualify… this is not 2006. As long as the market remains as it is, if you find your dream home, you’ll need to put in a strong offer immediately. And “strong” means pre-qualified (based on your statements), if not even pre-approved (based on submitted documents). You need to have this done before you even start looking, or you’ll lose out to those that were prepared.

Sellers definitely have more options than ever before, but I would caution against selling without a Realtor (“For Sale by Owner” or “FSBO”) or an”iAgent” like Redfin who claim to provide the same service as Realtors but can’t and don’t. Remember Purple Bricks? Neither do I. First off, Sellers – or their listing agents if they have one – are legally liable for keeping their property Covid-safe and there are special rules to follow. Second, a Seller might think they just sold their home for a great price, but with prices zooming it’s possible they sold too low. Surveys by Zillow, CAR, NAR (National Association of Realtors) and many others show time and again that unless you’re selling your home to somebody you already know, you will get less money and take longer to sell if you don’t hire a Realtor. If it’s simply a question of money, always think of the NET $ amount you would receive. That’s the amount of money you’ll be putting into your bank account. If the Listing Agent takes 3% but sells your home for 5% more, you come out ahead, and this doesn’t even take into account the stress relief. And keep in mind, more Realtors are moving with the times and the technology.

For example, here at Rock Real Estate, our broker is the most high-tech of them all, EXP REALTY, which means we can offer all kinds of “high-tech options” for buying and selling, such as selling via an online auction platform – the only way to guarantee selling for highest price – or selling in just days for CASH to our excusive Pool of “iBuyers” and Investors. And for us the days of Open Houses and people knocking on your door are over – we do most things virtually, and in-person showings are screened and made by appointment only on pre-scheduled days. Oh sorry, I digress, it’s just that I get excited about “the new way of buying & selling homes.”

So. . . what about 2021?

Alright, let’s get to the part everybody’s been waiting for… THE FUTURE!

First I’ll give you my personal opinion – I can’t help but think about the people who’ve lost their jobs or their businesses, not to mention those who’ve been unable to pay their rent or their mortgages. The eviction moratorium in California is set to expire on January 31st, 2021, and at some point the Lenders will start foreclosure proceedings… won’t they? And it seems inconceivable to me that these amazing mortgage rates – some now in the twos! – can stay this low. So I say, “get it while it’s hot”, especially if you’re thinking of selling, as homes are selling for record prices at record speed. If you’re serious about selling, sell now! I know some people who have recently sold their homes and are now renting, waiting for the bleep to hit the fan and prices to fall, at which time they’ll snap up properties at bargain prices.

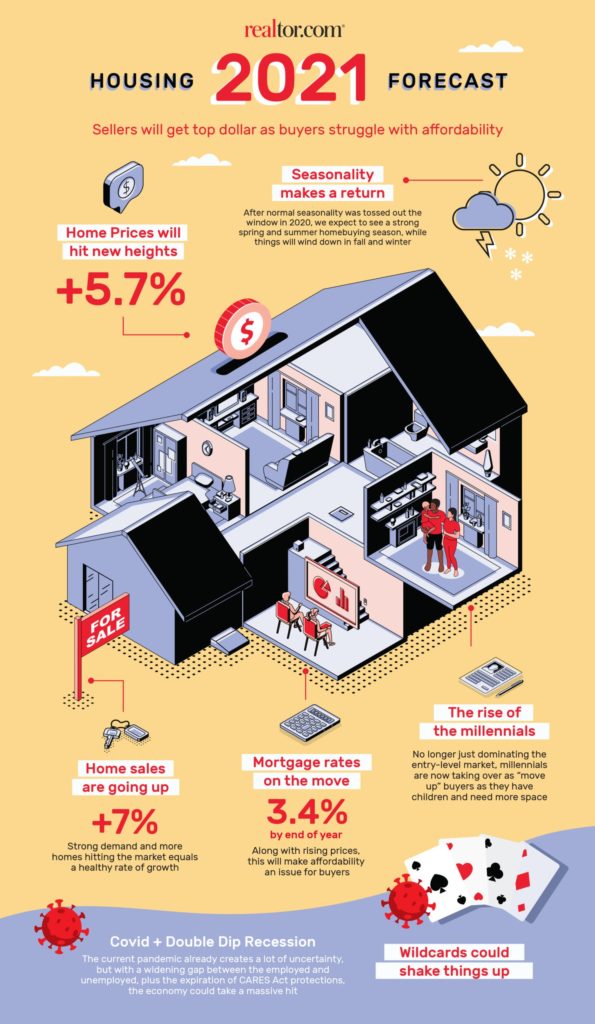

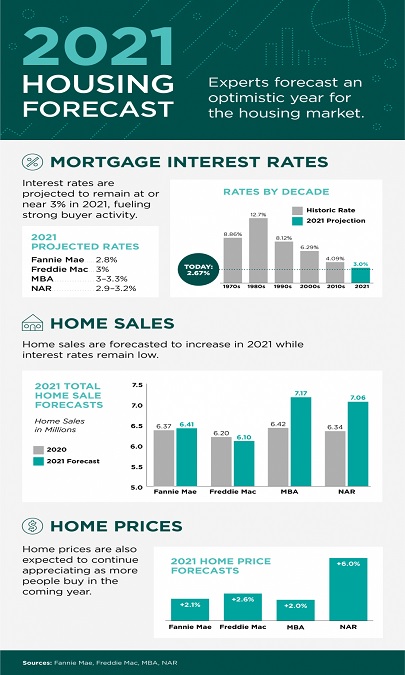

On the other hand, CAR’s early December real estate report (using the November 20 data) is amazingly positive. And they’re not the only ones. Some respected sources are predicting a booming economy as the lockdown shackles are taken off. Stat-wise, Home Prices for 2021 are expected to increase by 2% (Fannie Mae & MNA) to 5% (NAR), and only Freddie Mac sees a decline in the number of sales (see green chart above). Certainly, the vaccinations will free up many older California residents to sell their homes at record prices in the biggest seller’s market ever across California. The sellers in “the pandemic destination cities” may well sell high and downsize right out of California. And with so many fleeing the metropolitan areas, that might open doors for first-time homebuyers to buy in the city. Could there be a rainbow after the storm?

With Covid 19 shutdowns looking like they will continue in the winter months, housing markets are still in a holding pattern. CAR’s consumer housing sentiment index poll reported that 55% of consumers said it is a good time to sell, which was down from 59% last month, but still up from 51% one year ago. Will the vaccinations, new Fed stimulus funds, and the traditional spring market recovery put California’s limited housing supply to the test by May and keep the prices high? Maybe.

One thing everyone can agree on is that the Covid-19 Pandemic has supercharged the changes in society that technology had already been bringing us. What nobody can agree on is how it will all shake out once the pandemic ends. Will people go to movie theaters, sporting events and live concerts as much as they used to? What about restaurants, will people dine out regularly again? How many employers will force their employees to come back to the office 9-5 M-F… even though the job can be done just as well at home? Are people just going to sit on the couch swiping through social media on their smart phones chuckling at the latest tik tok video?

I think everyone agrees that 2020 can’t end soon enough, and I think most share the uneasy feeling that there will eventually be some fallout in real estate due to the pandemic, but will it be a hard landing or a soft landing? That is the question.

Thanks for reading, and please check out my related Blog Posts and my book:

Buying and Selling Homes in Today’s Market (online reader version)

The New Normal for the Housing Market

How COVID-19 May Affect Southern California’s Suburbs

Is Now a Good Time to Buy or Sell Real Estate?

First-Time Homebuyers – Now is The Time

Recent Comments