Eleven Major Real Estate Records were Broken in 2021

From super-low mortgage rates to sky-high home prices, 2021 has seen a number of real estate records fall. The housing market continually outdid itself this year, seeming to set new records every month thanks to a home buying rush that started in 2020, soon after the Covid pandemic struck. “The real estate market in 2021 was a continuation of the strong momentum carried over from 2020. Mortgage rates hovering at near-record lows fueled demand,” says Lawrence Yun, chief economist for the National Association of Realtors.

But historically low interest rates weren’t the only fuel to the housing market fire. As the country slowly emerged from COVID-19 lockdowns, many homeowners were looking for larger homes with home office space and for many, money was no object. “The pandemic and the work-from-home flexibility changed people’s desire of what is the right home – whether it was a larger home with space for a home office or moving further out from expensive areas to seek greater affordability,” says Yun. “This change in preference also fueled housing demand.”

The price of homes reached new records as buyers competed for a limited number of available homes. For homeowners though, it was a bonanza with new highs in home equity and record profits from sales.

As 2021 draws to a close, here’s a FACTUAL look at some of the new housing records set in 2021, followed up by the FUNNY wackiest real estate stories of 2021.

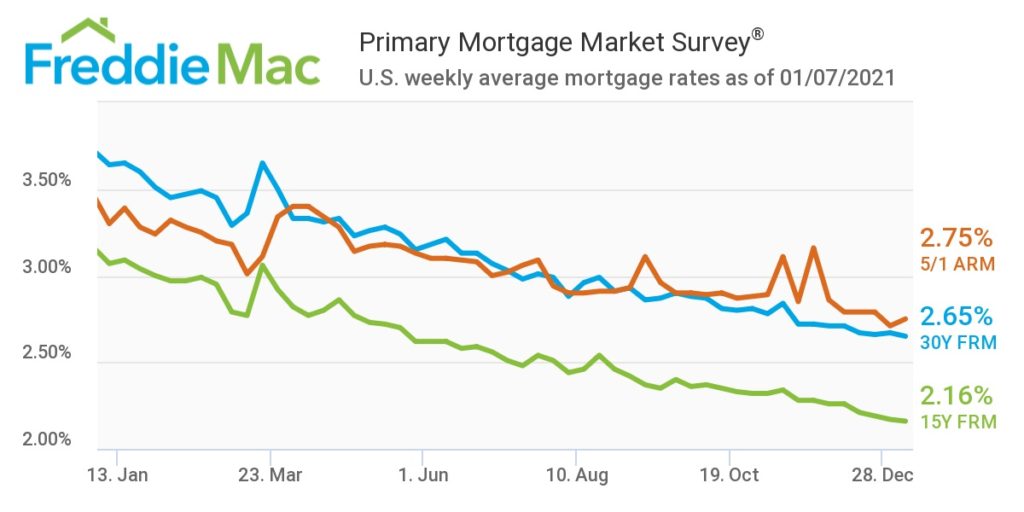

1. The rate on a 30-year mortgage hit a record low in 2021

The average rate on a 30-year fixed-rate mortgage reached an all-time record low of 2.65% on January 7, 2021 according to Freddie Mac. Since January, rates have risen but remain low. As of December 23, the current 30-year rate is 3.05%. Prior to the pandemic, the all-time low was 3.31%, set in 2012.

Upside: Folks, if you’re not purchasing, then you should be considering re-financing!

2. Housing Inventory was the lowest since stats have been tracked

2021 started with a record low 1.04 million homes for sale in the US. That represented just a 1.9 month supply at the pace of sales at the time. It was the lowest housing inventory since the National Association of Realtors (NAR) started keeping track in 1999. Since then, inventory has improved slightly but is nowhere near the 4-6 month supply considered balanced. At the end of November, the housing inventory rose slightly to a 2.1 month supply.

It is self-evident that even record low-interest rates have not been sufficient to motivate sellers who are unable or unwilling to list their properties for various reasons, factual or psychological and mostly Covid-related.

Locally, as a result, The Southern California region saw a decline in the number of sales of -3.8 percent from last year. Interestingly, LA county recorded a YTY sales growth of +1.8% (highest among all the six counties of Southern California) while Orange County’s sales decreased by 12.7 percent over the previous year. According to Realtor.com, the Month’s Supply of Inventory (SFH) for

- Ventura County is now 1.4 months.

- Southern California (6 counties) is now 1.7 months.

- the Los Angeles Metro Area is now 1.7 months.

- Los Angeles County is now 1.8 months.

- Riverside County is now 1.8 months.

- San Bernardino County is now 2.0 months.

Generally, a balanced market will lie somewhere between four and six months of supply. 1.7 months of supply is well short of what economists say is needed for a balanced market, where there is enough demand from buyers to equal the supply from sellers (basically an equal number of buyers and sellers). Hence, the Southern California housing market will continue to see upward pressure on home prices.

Upside: 2021 was arguably the best market to be a home seller in history!

3. Homes appreciated the most in value since records have been kept

Annual home price growth reached a new high in October, increasing 18% year-over-year in the US, according to housing data provider CoreLogic. It’s the largest margin of growth in the 45-years CoreLogic has been tracking. Some areas of Southern California have crushed that mark, with areas like Big Bear Lake setting records. There some signs that price growth may be slowing down as month-over-month price growth has been decreasing since hitting it’s peak in April.

Checking the local market, the Southern California six-county region saw a 14% year-over-year price gain with a median sales price — the point at which half of the homes sold for more and half sold for less — of $750,000 in November, according to the California Association of Realtors (CAR). The 14% increase was unchanged from the previous month, but marked sixteen months in a row for double-digit price increases. Breaking it down, from low to high:

- In Ventura County, the median price rose 13% to $858,500, while sales decreased by 1.0%.

- LA Metro had a year-over-year price gain of 13.9% overall, with a median price of $848,970. The city of Los Angeles had a 15.9% yearly gain with a median of $921,494.

- In Los Angeles County, the median price rose 14.3% to $769,500 in November, while sales increased by 1.8%.

- In Riverside County, the median price rose 19.8% to $586,900, while sales decreased by -6.8%. Temecula enjoyed a whopping 29.2% increase in 2021, up to a median of $691,822. This is is not a commuter-friendly area, so it has benefited greatly from the increase in working from home, plus a good area for a vacation home.

- In Orange County, the median price rose 23.7% to $1,150,000, while sales decreased by 12.7%. Of all the counties, Orange prices may be closest to the ceiling. Or not.

- San Bernardino County median prices hit $445,000 increasing 21.9% year-over-year, taking the cake locally and well out-performing the rest of the country. According to Zillow, Big Bear Lake enjoyed a staggering 38.5% one-year price increase. Again, this is an area that has benefited from more working from home as well as a good vacation home or short-term rental property.

Upside: If you are a homeowner, congratulations, you’re home has been a superb investment. And Buy & Hold SFR Investors might want to start thinking outside the (city) box.

4. 2021 set the record for total Purchase Mortgages in the US…

Total US purchase loan originations are on track to reach $1.61 trillion by the end of 2021, up from the previous record of $1.51 trillion set in 2005, according to the Mortgage Bankers Association.

5. …and a new record was set for highest average loan amount

The average dollar amount of purchase loans also reached an all-time monthly high, $418,000 for the month of February, according to the MBA. Since then, loan amounts have eased a bit, with the average loan amount being $416,200 as of December 17th.

Upshot: Buying a home is an expensive proposition.

6. Sellers asked for more money than ever before…

The median list price in the US reached a record-high of $385,000 in June, 2021, according to Realtor.com. It was the fifth straight month of record asking prices. Since that mid-summer high, things have cooled slightly. The median listing price has been easing lower and is currently at $379,000. Pre-pandemic the record was $325,000 set in June 2019.

7. … and Buyers delivered

The median sale price of existing homes also hit a new high in June reaching $362,800, according to NAR. Home sellers reaped the benefits of a red hot housing market as profit margins — the percentage of change between a home’s median purchase price and its resale price — increased by 48%, the highest rate since 2012. According to real estate data provider ATTOM, that translates into an average profit of $100,178 on the typical home sale during the third quarter of 2021 in the US, the highest profit ever recorded.

Checking the local market, CAR reported that some 60% of homes in LA sold above the asking price. Bidding wars have been the norm across the Southern California real estate market, although that may be changing. According to the latest Affordability Index from CAR, homes across LA are less affordable in Q3 2021 than they were in Q3 2020 and even Q2 2021, in part because mortgage rates are beginning to rise from the all-time historic low in January. The minimum qualifying income for the average home in LA is $156,800 with an expected monthly payment of $3,920.

Upshot: Buyers came up with the money to pay for these record high prices.

Downshot: Times are tough for first-time buyers (but fear not, Rock Real Estate will be posting helpful articles this coming year)

8. Homeowners have more “tappable Equity” than in any other time in history

Increasing prices led to a record $9.4 trillion in tappable equity – the amount of money a homeowner would be able to access from their home while still retaining 20% equity – during the third quarter of 2021, according to real estate data company Black Knight. Tappable equity is almost 90% higher than in 2006.

Upside: If you are a homeowner, congratulations, you now have major equity you can tap.

9. Homes sold faster than ever in 2021

Competition for the small number of homes available hit a peak during the 4 week period ending on April 4 when 61.5% of homes under contract had an accepted offer in two weeks and 46% in one week, the fastest pace since Redfin started tracking in 2012. Since then, the buying frenzy has cooled somewhat with 42% of homes under contract having an accepted offer in two weeks and 36% in one week for the four week period ending December 12th.

Upside: 2021 was a glorious time to be a home seller

10. Rents increased the most ever in 2021

The median rental price in the largest US metropolitan areas rose to $1,771 per month in November, up 19.7% from November 2020 and the highest price recorded since Realtor.com started tracking rents in 2019. That means renters are paying an average of $291 more per month in rent than they were a year ago, with the largest increase for 2-bedroom units.

Upshot: A great time to be a Landlord, not so great to be a tenant

11. Foreign real estate purchases reached a new low

Both the number of homes purchased, and the amount spent by international buyers reached new lows over the 12 month period ending in March 2021, according to the National Association of Realtors. Foreign investors purchased a total of 107,000 homes and spent $54.4 billion in US real estate purchases, obliterating the prior low of 2011 when investors bought 210,800 properties and spent $66.4 billion.

And now, for the FUN part of Real Estate!

“The Wackiest Real Estate Stories of 2021”

courtesy of Lloyd Segal, President, Los Angeles Real Estate Investors Club, LLC

If you build it they may not come

An Apple Valley, CA house was listed this year with a sale price of $309,000, although the listing states it was “built by accident” in 2007. Nobody seems to know how it had happened – how does a house get built by mistake? In the middle of the desert no less!? The contractor obviously made a terrible mistake and built it on the wrong raw land. After all, out in the desert all land starts to look the same. Was he singing “I’ve been through the desert on a horse with no name?” It has never been occupied and was abandoned by its owner at completion 14 years ago. Since then, the house has been destroyed by vandals and has a garage full of graffiti. Inside the house, the walls are ruined and fixtures and fittings ripped out. But this is the 2021 real estate market, where no listing is too weird, and every house has a buyer. Sure enough, the house that got built by mistake is now under contract, according to the listing.

The Creepiest Dollhouse

This New Orleans Louisiana listing ($149,000) could have just been your run-of-the-mill dilapidated hovel. But instead, the owner (a real estate agent, no less), decided to take the horror up a notch and include creepy old dolls in all of the photos. The effect was slightly terrifying but, in what can only be described as ‘strong 2021 real estate energy’, it worked! The property became the top listing on Realtor.com and with more MLS clicks than all other New Orleans listings. NOLA Living Realty agent Tony Bertucci told the Real Deal he had originally bought the decaying home to flip. Then he decided to sell “As Is” and go with its run-down state by posing scary Victorian dolls (left by the previous owner) in all the listing photos. “I did it just to get the house some attention because the house was so hideous and horrifying,” he said. It says everything about 2021 real estate that this place went under contract within days!

A Real Cliffhanger

A picture is worth a thousand words, as they say. And so it is for this “cliffhanger” of a property on Lake Michigan in Wisconsin, that found a buyer who clearly likes to live life “on the edge.” The real estate listing described the house as having “sweeping Lake Michigan frontage” and, to be fair, it wasn’t wrong. But the photos showed that well, it wasn’t quite up to code! Set on 1.7 acres of land with admittedly beautiful views, the ranch-style house made headlines for its precarious position on the verge of falling into Lake Michigan. Whoever bought this place – and it did sell, for the not-so-cheap in Michigan price of $250,000 – must be into cliff diving.

Get the Skinny on “The Spite House”

The “Skinny House” at 44 Hull Street in the North End of Boston, Massachusetts, is reported as having the “uncontested distinction of being the narrowest house in Boston” and probably in America. The house spans only 10.4 feet at Hull Street, its widest point, and tapers to 9.25 feet at the back. Inside the house, the outer walls are as little as 8.4 feet apart and none are more than 9.2 feet apart. The home’s narrowest interior point is 6.2 feet across, close enough to allow an adult to touch opposing walls. There are only five doors in the house, despite it having four levels. Instead of doors, the house has floors between each space. The second floor holds the living room and the bathroom (thankfully one of the few rooms with a door). “When guests stay over, we put a mattress down on the closet floor. Except for sleeping in the closet, they seem to like it.”

So here’s the skinny: According to an archivist at the Boston City Archives, the land was split into lots back in 1884. Two brothers inherited the land from their deceased father. While the first brother was away serving in the military, the second brother built a large single story home, leaving the first brother only a strip of property that neighbors felt certain was too tiny to build on. But when the first soldier returned and found his inheritance depleted, he built the narrow house to “spite” his brother (by blocking the sunlight and ruining his view). The house was in the news this year because it just sold for $1.2 million!

The Buyers took a Bath on this for $4.705 Million… no Sh*t!

Even Australia is experiencing an over-heated real estate market. For example, in the Kensington section of Sydney, a house sold for $4.705 million. That in and of itself is not surprising. But what is surprising is that the house does not have a kitchen or any bathrooms. Holy sh*t! The house at 25 Duke Street was uninhabitable but that didn’t put buyers off who were the winning bidders in a fierce auction! No kitchen, no toilets, crumbling ceilings and the fact it had been occupied by some (very filthy and hungry) squatters for two years didn’t keep it for selling for a massive $1.1 million over its original listing price! Gotta love those home auctions!

Tiny Houses are Old Hat

You might think that “Do-It-Yourself” (“DIY”) tiny homes that you order online, or the recent “Tiny House” investing gold rush are the latest real estate trends, but that’s actually far from the case. In the 1900s, Sears featured a $652 kit for making a house in their catalogs. The mail-order kit featured the blueprint and all the pieces you’d need to build a simple house. Many settlers who came to America and bought a plot of land would build this type of simple house on it as they settled into life in the new country. According to NPR, between 70,000 and 75,000 people ordered houses from Sears this way by 1940. Some experts estimate that about 70 percent of Sears houses are still standing today! That means that somewhere out there in Americana, there are approximately 50,000 of these tiny homes still in existence.

Bavarian town experiencing a meteoric rise.

Believe it or not, there is a Bavarian town named Nordlingen that was actually built over a meteor that slammed into the Earth some 15 million years ago. Of course, I don’t know for sure because I wasn’t there. Far from staying away, the locals decided to build a town on the remaining crater, and you can still see the circular layout of the crater to this day. But I hear the prices there are out of this world.

Everybody knows how this story ends!

This may not be a real estate story but it’s too irresistible to leave out. Believe it or not, there is a Titanic Museum in Pigeon Forge, Tennessee (nowhere near water!). As you might expect, if entered the museum, you would walk onto a half-scale replica of the Titanic smashing into an iceberg. But according to the Knoxville News Sentinel, the iceberg inside the Museum actually collapsed and seriously injured three guests standing on the Titanic replica. The Museum’s Facebook page stated, “Needless to say, we never would have expected an incident like this to occur as the safety of our guests and crew members are always top of mind,” which is ironically almost word-for-word what the owners of the real Titanic said after the 1912 catastrophe.

Fowl Language is for the Birds

OK this has absolutely no connection to real estate (unless you’re thinking of buying a zoo), and in fact it’s for the birds! Lincolnshire Wildlife Park, in Friskney, England, adopted five African Grey parrots this summer and put them in quarantine together. Terrible idea! During their time together, the birds apparently taught each other some quite foul language, something they now engage in quite often, according to Steve Nichols, the park’s CEO. “I get called a ‘fat f_ _k’ every time I walk past,” Nichols told CNN. Nichols proclaims that potty-mouthed parrots are popular in his profession. “For the last 25 years, we have always taken in parrots that have sometimes had a bit of ‘blue language’ and we have gotten used to that,” he told Lincolnshire Live. “But when we took in five in the same week it meant there was this room full of swearing birds out control. The more they swear the more you usually laugh, which then triggers them to swear even more.” Nichols said the cursing birds sound “like an old frat house.” Although he and fellow park employees found the whole thing funny, Nichols decided it would be best to quarantine these fowl-mouthed birds out of view before visiting kids could hear them say “Get outta here you little sh*theads!”

Recent Comments