Welcome to the holiday edition of the Rock Real Estate Video Newsletter. That’s right folks I said Video Newsletter as it has become apparent that people just don’t like to read anymore, at least beyond a text from a friend. Now if you’d like to read this video it’s been transcribed and you can read it at rockrealestate.org on our blog site or in this newsletter below… But if you’re like most people you can skip all that and just watch the video.

So let’s talk about residential real estate shall we? Ever since COVID came out it’s been quite a wild ride in the housing market. Very few people thought that the inventory level would reduce so much that prices would rise the 40% or so that they have risen since the pandemic began. Sure we thought that the inventory would get smaller because people were afraid to move, but we figured that the hit on the economy would lower demand as much as the supply was lowered. Boy were we all wrong!

Looking back on it – and hindsight is always 2020 – it looks like The Fed held the interest rates down too long. February of 2021 saw the lowest mortgage interest rates in the history of mankind which increased demand, and combining that with the low inventory for people afraid to move due to COVID concerns, prices rose at an unprecedented rate. The problem was that the economy became overheated which caused inflation at rates not seen in 40 years. As I explained way back on my January 20th 2022 video inflation and real estate, the only way to tame inflation is to raise interest rates. So I called it way back in January but even I did not expect the rates to rise that much and that quickly. Rates skyrocketed from the high twos in February 2022 to the fives and sixes and sometimes even 7% range only six months later.

Buyers quickly realized that they could not afford the houses that they had been looking at and now had to consider smaller houses or not moving at all. Thus demand has lowered which in theory means that prices should lower accordingly.

There is an old investing maxim that the general public is three months behind the times and boy was this apparent this Summer and Fall of 2022 while buyers quickly realized they had to drastically adjust their expectations but sellers have been slow to respond. All I have to do is drive through my neighborhood to see For Sale signs on houses that now have been on the market for as long as six months with the sellers refusing to lower their prices. Some of them have cancelled their listings and decided not to sell at all which is the worst possible news for Realtors who have worked all summer and we’ll have zero income to show for it. This is sad for my realtor friends and I because I’ve been telling people for two years that now was the time to move and unfortunately I see that a lot of people waited too long and then decided to sell when it was already too late to catch those bidding wars.

I’ve titled this video SEASON OF CHANGE because hopefully now even the sellers are realizing that the days of tossing out a simple Zillow ad and having 20 offers in the first week above listing price are just as long gone as 2.75% interest rates.

So it looks like the Grinch is getting his way for the holiday season of 2022 with low supply and low demand meaning very few purchases and sales. Real estate agents and other professionals such as lenders, escrow officers, inspectors and appraisers are crying in their spiked eggnog for sure.

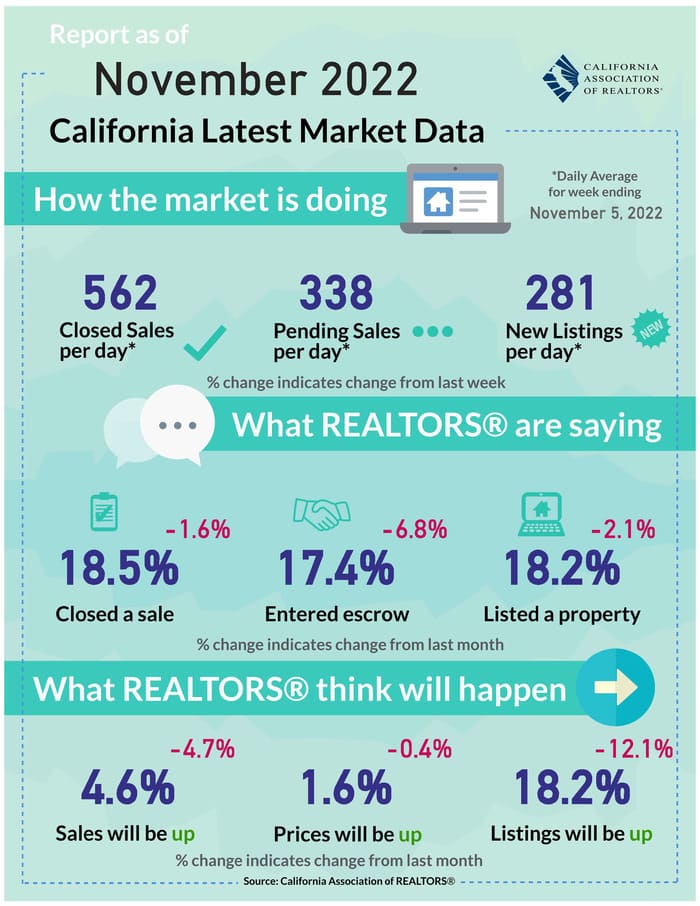

Here are some stats from the California Association of Realtors.

First let’s talk about volume of sales. CAR’s October 2022 report showed that home sales had fallen for 16 straight months year over year, and it was the third time in the last three months that sales fell more than 30% from the previous year, with the segment between $750,000 and $999,000 experiencing the steepest decline at 40.8% and the luxury market having the smallest sales decline in October at 34.1%, according to C.A.R. It was the lowest sales level since February 2008 and the steepest year-over-year fall since December 2007, excluding the effects of the pandemic. Geographically, Southern California had the biggest drop of all regions, with sales plunging 40.8 percent from a year ago.

Now let’s talk about prices. Surprisingly, median prices in all major regions (except the Bay Area) continued to grow on a year-over-year basis with the price per square foot at $404, up from $389 in October a year ago. In fact, Southern California had a year-over-year price gain of 3.2 percent, with the median price being $773,810. That just goes to show you how tight the inventory is.

As I was saying, Sellers have not read the memo and DOM, or Days On the Market, has increased in California from 11 days in October 2021 to 23 days in October 2022 an increase of over 100%.

Alright, now that I’ve gotten you thoroughly depressed let’s look for

The silver lining in the real estate clouds.

First of all, remember that with these stats, we are comparing to 2021, when the California housing market sizzled to break all records. According to Zillow, at the state level, California’s housing market remains the most valuable in the country, with a total value of $9.24 trillion as of last December, accounting for more than a fifth – 21.3 percent – of the national total.

And we have good news for buyers. If you have been wanting to buy a new home or investment property, you may have been sitting out the hot market of the past two years waiting for prices to drop. By May, common sense was kicking in, and it really had gotten to the point where even some Realtors we’re feeling a little guilty that they had sold a crummy two-bedroom shack for $1,000,000. The good news for buyers is that prices will almost certainly drop from their peak levels of May and June of 2022. The question is how far will they drop?

According to C.A.R.’s “2023 California Housing Market Forecast,” the median home price in California is expected to drop 8.8 percent to $758,600 in 2023, after rising 5.7 percent to $831,460 in 2022 from $786,700 in 2021. Next year’s median price rise will be slowed by a less competitive housing market for homebuyers and a stabilization in the mix of home sales.

Sadly, there may also be more motivated sellers coming in 2023 if the economic outlook gets worse. There are a lot of people who have had Loan forbearances that are now due, and number of people have lost their jobs or had their income cut to to the COVID pandemic and other reasons. This would increase the supply of homes which would make things even easier for buyers. “Motivated sellers” translates to good deals for buyers who find them.

Also something that buyers in California might want to think about is that if they purchase the right property in the right location the new California laws make it easy to turn a single family residence into an income property bringing in not only one but possibly up to three units of rental income. (Make sure to watch my ADU YouTube videos entitled “The New California Gold Rush” where ADU guru Seth Phillips divulges the secrets of turning the right single family home into two separate two unit properties.) So this means if a buyer still wants that larger property they can now partially or fully cover the now higher mortgage payments by renting out one or more units. Nobody likes to have a loss of privacy but keep in mind that if you’re purchasing a new property some properties are well set up or a guest unit or three with minimal loss of privacy. Watch the video of contact me and I’ll tell you which ones.

Is there any good news for sellers? Well if you are a seller who is planning on moving to a new home or an investor selling one property doing a 1031 exchange and buying another, a drop in your selling price is a wash because the purchase price of your new property will also be less.

The other good news for sellers is that the COVID-19 pandemic accelerated the trend towards working from home. If you are now able to work from home, you are now able to move to areas where you can get much more house in a better neighborhood with better schools and less crime for the same money you’d be paying in your current neighborhood. For example, I’ve been talking to everybody I can about relocating from the city of Los Angeles to the Temecula area for three years. Temecula is a perfect example of a residential area that is grossly underpriced because of the fact that it was a bad location for commuting to the big city proposition 19 has also encouraged people over 62 to move within the state of California and transfer their low property tax basis to their new California abode.

Most of us Californians know at least one family who has moved out of state, so in a way this is good news for sellers because for example you could sell your $1,000,000 California home and buy a similar home in, say, Florida for $700,000. This is also great for California residential real estate investors who can sell a $1,000,000 single family rental house in California and do a 1031 exchange to purchase a $1,000,000 fourplex in places like Orlando FL that have landlord-friendly laws. I prefer Orlando because with the number one tourist attraction in the country 12 months of the year in DisneyWorld you have the option of short term rentals (AirBnB) as well as leasing.

A lot of seniors are flocking to places like Florida and purchasing their retirement homes with reverse mortgages, which means they have the option of not paying their mortgage payment if they so choose. By the way I just want to mention that I now have a private reverse mortgage program through my lender that is available to people as low as 55 years of age. You can refinance your current home or purchase a new one and never need to make a mortgage payment again.

So to wrap things up, the 2022 holiday season is A SEASON OF CHANGE in the real estate housing market. Those who recognize and understand these changes will come out ahead, so I hope that I’ve been able to help with this blog and video.

As always, feel free to go to stuartsimone.com to set up a free consultation we can talk about anything regarding residential real estate, including all the latest California laws, and I can tell you about my network of 86,000 agents all over the United States that can find you the best real estate for you in virtually any corner of the country in case you “wanna get away.”

Recent Comments