If you are hoping to find a trusted probate advisor that will walk with you through the entire process, I’d love to talk with you to find out how I can help you every step of the way.

From both professional and personal experience, I understand the stress & complexity associated with your responsibilities at this time. It’s not easy. Managing an estate is an emotional and complicated task. Family conflict, repairs, market conditions, out-of-state heirs and financial constraints contribute to the challenge of selling an estate. The burden often creates a situation feels overwhelming.

When navigating the probate process, having the right professionals in your corner makes all the difference. Besides my team, I personally hold an Attorney’s License (I have an Estate Planning Practice and have Probate case experience) and a Real Estate License (with Probate Certification), so I have the experience and knowledge to guide you through the entire process from A-Z.

-Stuart Simone, Certified Probate Realty Specialist

PROBATE FAQs

What IS Probate?

Probate means that there is a court case that deals with:

• Transferring the property of someone who has died to the heirs or beneficiaries;

• Deciding if a will is valid; and

• Taking care of the financial responsibilities of the person who died.

In a probate case, an executor (if there is a will) or an administrator (if there is no will) is appointed by the court as personal representative to collect the assets, pay the debts and expenses, and then distribute the remainder of the estate to the beneficiaries (those who have the legal right to inherit), all under the supervision of the court. The entire case can take between 9 months to 2 years, maybe even longer. Besides that, the filing fees will be over $930.00 and the attorney fees will be in the thousands if not tens of thousands of dollars (there is a statutory fee scheme based on the value of the Probate Estate.) Both the Attorney and Personal Representative are entitled to a fairly large portion of the estate, meaning if you do not have a living trust with pourover will, your heirs will receive less than they could have. That’s why we offer a complete Living Trust package for everyone we come in contact with: we honestly believe it’s “Priceless.”

What are the Probate Attorney’s Statutory fees?

Probate fees (e.g., attorney’s fees and personal representative’s fees) are set by California’s Probate Code §10810. The statutory fees prescribed by §10810 are based on the value* of the estate, as determined during the probate process. The value of the estate is generally determined by the inventory conducted by the estate’s executor, and sometimes with the assistance of appraisers designated by the court.

*Unfortunately, in making the valuation, the court does not consider the debts of the estate to offset the gross valuation, and thus determines the fees based upon just the gross valuation of the assets in probate. For example, if a house is appraised at $500,000 but has an outstanding mortgage of $300,000, the house is still valued at $500,000 for the purposes of calculating statutory probate fees.

Statutory probate fees under Probate Code §10810 are as follows:

- 4% of the first $100,000 of the estate

- 3% of the next $100,000

- 2% of the next $800,000

- 1% of the next $9,000,000

- 0.5% of the next $15,000,000

*Note that the above-referenced calculations may have to be done twice: once to calculate the attorney’s statutory fee and once to calculate the personal representative’s statutory fee. See the example calculations below.

Probate Statutory Fees and Court Cost

BASED ON THE GROSS VALUE OF AN ESTATE

- $500,000 $13,000 x 2 = $26,000

- $600,000 $15,000 x 2 = $30,000

- $700,000 $17,000 x 2 = $34,000

- $800,000 $19,000 x 2 = $38,000

- $900,000 $21,000 x 2 = $42,000

- $1 Million $23,000 x 2 = $46,000

- $5 Million $61,000 x 2 = $122,000

The best thing is to avoid probate completely by creating a Living Trust with Pour-Over Will.

Will I always need to file a full-blown Probate Case in California?

The answer is NO. Here are some situations where a full Probate case can be avoided:

a) There is a Living Trust with Pour-Over Will

If the Trust was funded and the Pour-Over Will is properly drafted and does it’s job of “pouring over” any new assets that were not named in the Trust, then the family does not need to go to court at all as there is no need for Court Interference. (This is why Probate Property Service is always advising out clients to purchase a Living Trust Package from Simone Legal or any good Estate Planning Attorney.)

b) Property was deeded out of the Living Trust (usually for the purposes of a Re-Fi mortgage) but not transferred back to the Living Trust.

In this situation, your Probate Attorney can file what is known in California as a Heggstad Petition, which should not take more than three months to accomplish. Again, this usually can’t happen unless there is a Living Trust with a Pour-Over Will.

c) A couple has been married many years, but the property title is on in one name, and that spouses passes away.

The the property is considered “Community Property” (i.e. acquired during the marriage but not inherit), then this Spousal Property Petition case should only last 2-4 months.

d) There is unimproved land worth less than $55,425.

The Court will appoint a Probate Referee to assign the value of the land resulting in an Affidavit of Real Property of Small Value. If the property is worth between $55,425 and $166,250, then a Petition to Determine Succession to Real Property is filed, where the Referee determines the value and the judge determines who gets what.

e) The total value of the Probate Estate is $166,250 or less (as of 1/1/2020)

This is considered a Streamlined Probate Case and should cost about $2500.

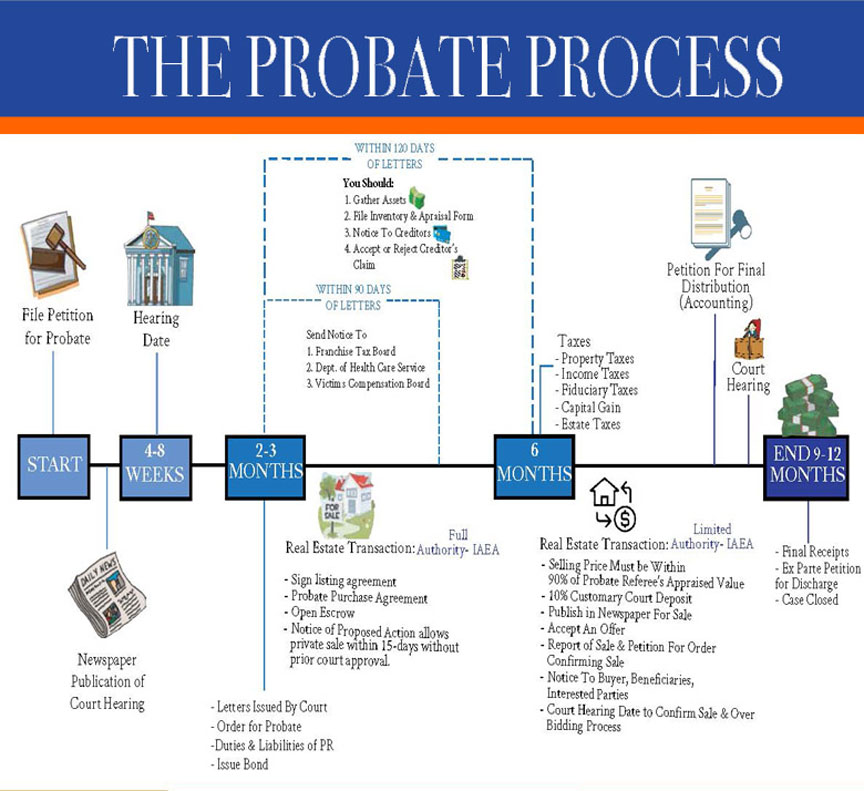

What are the steps in a full Probate Court Case?

(1) Determine the Executor/Administrator

If there is a Will, then the custodian of the will (the person who has the will at the time of the person’s death) MUST, within 30 days of the person’s death:

- Take the original will to the probate court clerk’s office within 30 days.

- Send a copy of the will to the Executor (if the executor cannot be found, then the will can be sent to a person named in the will as a beneficiary).

If the custodian does not do these things, he or she can be sued for damages caused.

If there is no will and a court case is needed, the person who wants to be the Administrator must file a Petition for Letters of Administration. The administrator usually is the spouse, domestic partner, or close relative of the dead person. The probate court will appoint an administrator to manage the estate during the probate process.

At this point, the Personal Representative (“Executor” if there is a will, “Administrator” if not) should shop for attorneys and bring as many heirs as possible to meet with the top choice. The distribution of the estate should be discussed, which usually includes Real Estate. Sometimes a Realtor is brought in at this time as well to help with the process.

(2) File the Petition for Probate.

Someone, called “the petitioner,” must start a case in court by filing a Petition for Probate (CA Form DE-111). The case must be filed in the county where the person who died lived (or if the person lived outside of California, in the California county where that person owned property).

The Petition for Probate has different options, depending on the situation regarding the will:

- Petition for Probate of Will and for Letters Testamentary

- Petition for Probate of Will and for Letters of Administration with Will Annexed

- Petition for Letters of Administration

In addition, a probate case requires more forms than just the Petition for Probate form. As we will soon see, a very important part of the petition regarding Real Estate is whether the personal representative is to have Full Authority or Limited Authority under the IAEA. (The Independent Administration of Estates Act (IAEA) is a series of laws allowing the personal representative to administer most aspects of the decedent’s estate without court supervision, including the sale of Real Estate.) It is NOT a good idea for a petitioner to try to draft and file a probate petition — hire an attorney for this.

(3) Administer the Probate Court Case

- The probate clerk sets a hearing date.

- The petitioner must give Notice of Hearing to anyone who may have the right to get some part of the estate, plus the surviving family members even if there is a will and they are not named in it. Any person who is interested in the court case may file a Request for Special Notice (Form DE-154), which means that they must receive a copy of paperwork filed by the person who is chosen to manage the estate.

- The petitioner CANNOT mail the Notice. It must be mailed by any other adult who is not a party to the case.

- The petitioner must arrange for Notice to be published in a newspaper of general circulation.

- A court probate examiner reviews the case before the hearing to see if it was done correctly.

- Once all the paperwork has been reviewed by the examiner and corrected, if necessary, the judge decides who to appoint to be in charge as the personal representative of the estate (either “administrator” or “executor”).

- The initial court hearing is extremely important to the entire process. It is heard approximately 2-3 months after the petition was filed, and the Court (judge) many issue the following at this hearing:

Order For Probate (general orders by the Court), Letters (giving power of attorney to the personal representative), Duties & Liabilities of the personal representative. Sometimes the court will issue a Bond, which is “insurance” that the heirs will be paid.

Importantly, the court will determine if the Personal Representative is given Full or Limited Authority. Full AUthority is typical, but if the Personal Representative is challenged for any number of reasons by an interested party such as a possible heir, then the court could determine (sometimes at a later hearing) that the Personal Representative is only given Limtied Authority. This is a big deal, as we’ll see next. - [A] REGARDING REAL ESTATE, if the Personal Representative has Full Authority under the IAEA, he/she can file a Notice of Proposed Action and could sell the decedent’s home and other property in approximately three months from the start of the case. Typically the Personal Representative will shop for and hire a real estate agent at this time. When the property sells, the buyer immediately gets the property and the Realtors get their commission. Proceeds of the sale could be used to satisfy any creditor’s claims filed against the estate. However, the heirs, personal representative and probate attorney do not receive any money until the Final Accounting is approved by the Court. (The court won’t allow the Final Accounting to be filed until the four month

- [B] If the Personal Representative only has Limited Authority, then the court is much more involved and the process of selling the property is far more complex:

1) The court appoints a Probate Referee to Appraise the property

2) The property must be published in a newspaper, when a buyer’s offer is accepted, the court requires a 10% deposit from that buyer,

3) Once all contingencies are cleared, the attorney sets a court date and files a Petition for Order Confirming Sale and Notice is given to the buyer and others,

4) An over-bidding process takes place at the hearing, where other potential buyers can get into an auction-type situation,

5) The Court issues it’s Order as to who the buyer is and for how much money, and

6) escrow can finally close. - The personal representative gathers up the assets and prepares an Inventory and Appraisal to be filed. The personal representative usually will also need to contact a probate referee to value the nonmonetary assets. Find the contact information for a probate referee in your county. (Get more information on probate referees.)

- The personal representative provides formal notice to creditors with the Notice of Administration to Creditors and pays the debts.

- A final personal income tax return is prepared for the person who died.

- The probate court figures out who gets what property.

- A Report of Sale and Petition for Order Confirming Sale of Real Property is filed with the court so that sales of real property are confirmed by the court.

- If the estate earned any money (such as interest or profit in a sale), the personal representative will have to submit a final estate tax return.

- During this process, the attorney or pro per Personal Representative will go to the court website to review the “probate notes” that the court posts prior to each hearing.

- The personal representative reports to the court on how the estate was handled. This report is a final plan and accounting. This is a lengthy and technical pleading and should be drafted by an experienced probate attorney. The report is scheduled for hearing so the judge can review how the personal representative handled everything. The judge needs to be satisfied that everything has been properly taken care of.

- After filing with the court any required final receipts to show that everyone received their property from the estate, the court discharges the personal representative from his or her duties.

As you can see, this is the kind of process best handled by an experienced probate attorney.

TAKEAWAYS:

This is no time to cut corners – these cases are backlogged in the court system and can take a long time, and a personal representative trying to do it alone risks having the entire case dismissed. Instead,

Select your “PROBATE TEAM”, consisting of a trusted Probate Attorney and Probate Realtor. A good Probate Realtor will more than pay for himself by formulating the best fixing up, marketing and selling strategy.

If you’d like more information or to discuss any problems you’re having, please feel free to contact us at any time. I can be reached directly at (818) 717-7605. Our #1 objective is to “Provide True Value above and beyond”. We’re here to help you in any way we can during this difficult time. Whether you are ready to sell or just need someone to answer your questions, please feel free to call any time.

The EXP Advantage

We are plugged in to the most innovative Realty Brokerage in the world, EXP, "The Amazon of Real Estate." We have direct lines to major iBuyers, mortgage lenders, CASH buyers, "pay later" renovation, and our unique residential Online Auction platform - nobody else can say that!

massive marketing

When you list with us, your property will have it's own 3D Tour Website, Aerial Video, and multiple posts all over social media, including videos and virtual open houses. We go all out for every client, every time. Oh yeah, and we pay for all that stuff!

List Your Property Risk Free

We have a Performance Guarantee with every Listing... because we are that confident. Icons in the Real Estate Business such as FortuneBuilders' Than Merrill and Tarek El Moussa of HGTV's "Flip Or Flop" fame are joining eXP Realty every day, and for good reason. They see the benefit!