With housing in SoCal becoming more scarce and more expensive, it was only a matter of time before the Government acted, and a statewide “ADU Permit” law was passed in 2020 and made even more powerful – over-riding local prohibitions on licensed conversions – effective January, 2021.

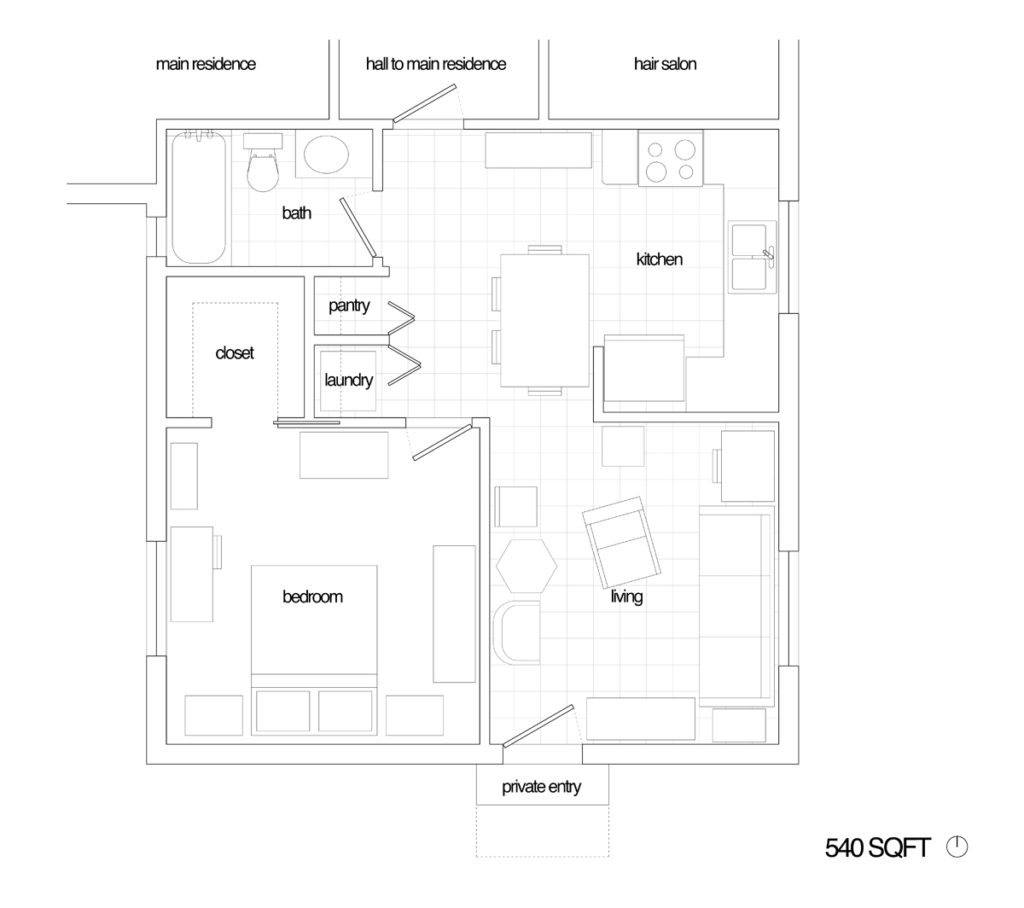

Garage conversions are the cheapest way to build an ADU—and offer the greatest ROI. While a new 500sqft stand-alone unit in Southern California can run $160,000 or more, a 400sqft garage conversion starts at around $95,000 according to a leading SoCal ADU Specialist. Is it worth it? When you factor in the value a 400sf ADU adds to your home, and the income you’ll get if you rent it out, it’s hard to find another investment that comes close.

But sticker shock is real when homeowners realize it’s going to cost more than the $50,000 most think it will be. Garage conversions (and all granny flats) cost more per square foot than typical single-family homes. Here’s why:

- You’re paying for all the “infrastructure” of a full-sized home (plumbing, heating, bath and kitchen) without nearly as much “cheap square footage” (bedrooms, halls, family rooms, living rooms) to offset the price per square foot.

- Even if you use the envelope of the existing garage, you will need to install everything from infrastructure to final finishes.

- There are fixed costs associated with permitting and design fees.

- Margins are smaller for general contractors, subs, and architects, so they charge more per square foot compared to larger homes.

Because of this, many homeowners are tempted to cut corners and do it themsleves or hire unlicensed (and uninsured) labor.

Unfortunately, issues can arise when the home is bought, sold (or refinanced) if the renovations are not done by the book. There is a risk that the purchase could fall through, and that would be bad for the buyer and seller alike.

Below are the regulations, (Fannie / FHA / VA) outlining the specifics of the renovation process which will help agents advise their clients (either buyers or sellers) so you escrow can close in time and with a minimal expense.

NOTE: All “Conversions” are not “ADUs – (Accessory Dwelling Units) – and ADU has been inspected and permitted throughout the entire process.

For information on ADUs

http://hcd.ca.gov/policy-research/AccessoryDwellingUnits.shtml

For breaking news regarding “ADUs” visit:https://www.facebook.com/TitleGeek/

Rules for Appraising Conversions*

All of the following conditions are required *at this time* to allow a garage conversion without permits for all financing:

· If a garage was converted without a permit, the appraiser must show the value as a garage, not as a converted room.

The appraiser must also estimate a cost to cure for re-conversion back to a garage.

· If the garage is converted to living space with no extra plumbing or electrical work, no permit is required if the appraiser indicates it was completed in a “workmanlike manner”, the comparables support the value, and the lack of car storage is not prohibited by local ordinances.

· If the appraiser can obtain comparables that are the same as the non-permitted living space, no adjustment to the property value is necessary.

If the comparables do not have a similar living space the room must be valued based on its original use.

This requirement applies to family rooms and patio enclosures as well.

However, if the above requirements for garage conversions are not met, permits are required unless the loan meets the un-permitted addition requirements as listed in the Lending Product Profile.

Additionally, if permits are specifically required by purchase agreement, sales contract, etc. for the conversion, then they must be provided.

Un-Permitted Additions… that could pass

· The subject addition complies with all lending guidelines

· The quality of the work is described in the appraisal and deemed acceptable (“workmanlike quality”) by the appraiser

· The addition doesn’t result in a change in the number of units comprising the subject property (e.g. a 1 unit converted into a 2 unit – regardless of how the appraiser classifies the property with the addition, improvement or conversion)

· If the appraiser gives the un-permitted addition value, the appraiser must be able to demonstrate market acceptance by the use of comparable sales with similar additions and state the following in the appraisal

· If Non-Permitted additions are typical for the market area and a typical buyer would consider the “un-permitted” additional square footage to be part of the overall square footage of the property.

· The appraiser has no reason to believe the addition would not pass inspection for a permit.

Note: These guidelines are subject to change, so check with your lender immediately to find out their current guidelines. Although Fannie / VA and FHA all allow for conversions, many lenders at this time have “overlays” and will not lend on these properties.

“Overlays” are additional lending guidelines that lenders require in order to satisfy their underwriters and Wall Street investors.

Typically “depositories” (credit unions and banks) as well as so called “direct lenders” are the type of lenders who have overlays and many WILL NOT LEND on un-permitted conversions.

In summary, find out FOR SURE if the “conversion” is a legal “ADU” or not. If not, then ask your MLO for the lending institution’s “conversion guidelines” before you commit to their institution and this purchase. You don’t want to get halfway through escrow and THEN find out the lender won’t lend on this property!

Recent Comments