What Goes Up Must Come Down… Right?

Whether you’re a professional real estate investor or just a casual observer dreaming of someday nabbing that dream home, just about everyone has noticed that home prices have skyrocketed since the Covid-19 pandemic hit. A housing market slump looked all but assured in 2020 as strict state-issued lockdowns pushed the U.S. unemployment rate to its highest level since the Great Depression era, and many states had banned in-person home showings. However, prices certainly didn’t slump. Although very few saw it coming, in retrospect, it shouldn’t be surprising. What happened was, a vicious circle was started that created a home price elevator to the top. It all started with the lockdown and accompanying panic, people were scared to leave their home, and they certainly weren’t about to let hoards of strangers come into their house mask gloves booties or not. So folks that normally would have moved stayed put. That caused the housing inventory shrank dramatically. You know the laws of economics, it’s supply and demand. When supply drops or demand rises, prices rise.

Three years after the scary part of the pandemic has passed and people are moving about freely and unmasked we still have a low inventory. Why? Because with such a low supply, people who normally would have moved are staying put because while they know they can sell their home quickly, they’re afraid they won’t be able to find their next home and they’ll end up living in a hotel room somewhere. Where there are many realtors and lenders like me who have come up with solutions to this concern, perception is reality and the inventory has stayed low because so many are hunkering down. Add in the fact that interest rates have risen by a large percentage and that has turned off many other potential buyers. The interesting thing about that is that rates are still historically low, but again perception is reality and news outlets know full well that “end of the world” stories get the highest ratings, not the cloud’s silver lining.

What about demand? That’s gone up too, and the reason may surprise you. “We’ve been in a strong seller’s market for some time now because of a shift in the mindset of millennials regarding homeownership. Millennials used to be the enemy of real estate, but now they are the largest consumer, comprising 43% of buyers in today’s market.” explains Rogers Healy, owner and CEO of The Rogers Healy Companies in Dallas, TX. “The decision millennials have collectively made to turn away from rental properties and own real estate shifted the market completely.” And another thing, how about that stock market? Did you know that stocks have lost 20% on average this year? And “sure-thing up & comer” Netflix went from 710 to 120 a share with other techie stocks crashing s well. And the odd thing is that while bonds normally go up when stocks go down, they are also going down this time. So the senior market, with so much of their retirement nest eggs in mutual funds, have just lost 20% of their retirement so they’re not about to take any chances moving. (On a side note, I’ve been saying “invest in real estate” for years, and lookie here, stocks bonds dropping and real estate rising…)

So… Have Housing Prices Peaked?

So prices have been going up, up and UP until now they have reached all-time highs. But we all know this can’t last forever, can it? So the BIG Question on everyone’s mind right now is, “have prices reached their peak”? The easy answer is YES, but hold up. If you asked people last year if they were at their peak, most would have said yes… and then prices rose another 20%! So maybe we should see what the “experts” have to say.

THE NATIONAL HOUSING MARKET

Let’s start with the national scene. Moody’s Analytics chief economist Mark Zandi is ready to call it. He told Fortune magazine in June that “The housing market has peaked…everything points to a rolling over of the housing market. Housing demand is coming down fast. Home price growth [will] go flat here pretty quickly; we will see [home] price declines in a significant number of markets.” Unlike a stock market correction, which means a greater than 10% drop in equities, Zandi says a “housing correction” means the end of a housing boom and the beginning of a period where home prices will fall in some regional markets. Over the coming 12 months, he expects year-over-year home price growth overall to be 0%. If that comes true, it would mark the worst 12-month stretch since 2012. It would also be whiplash for real estate agents and brokers who’ve watched home prices soar 19.8% over the past year.

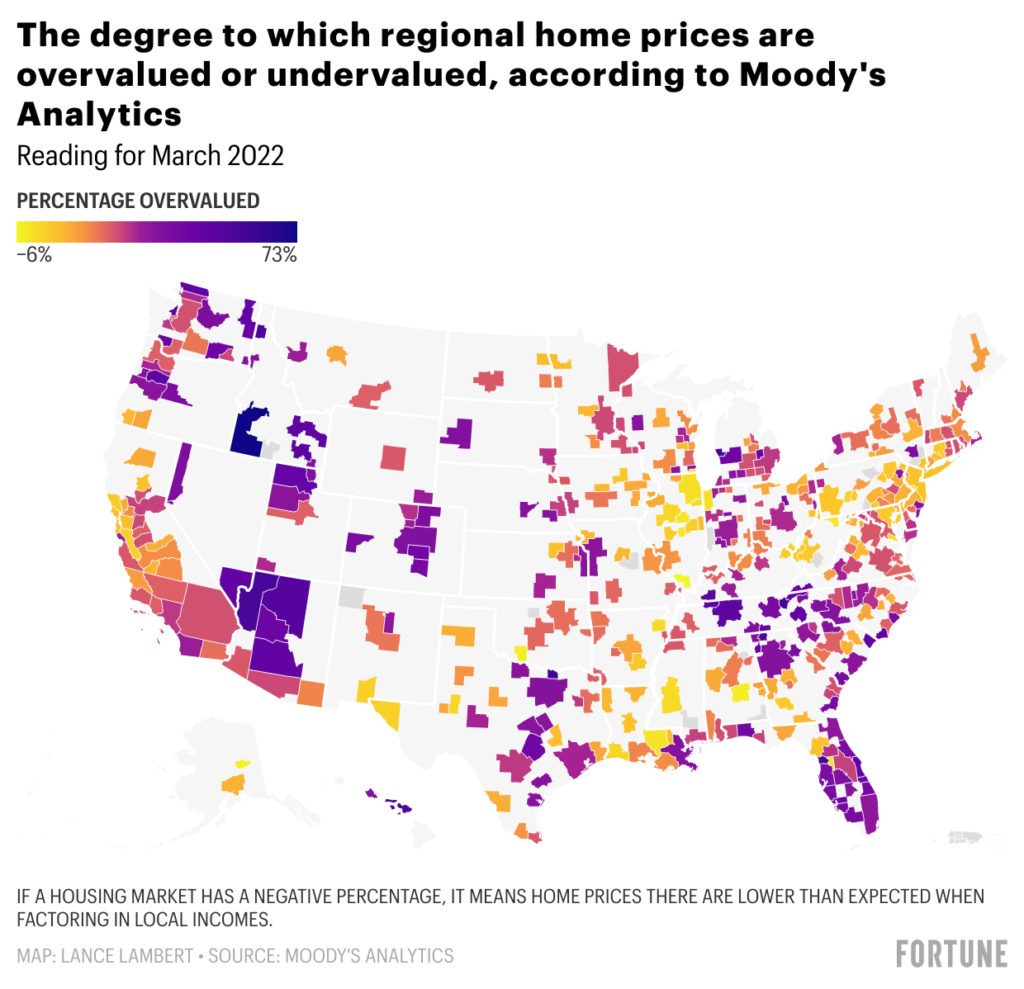

Among the nation’s largest 392 housing markets, 96% have home prices that are “overvalued” relative to what local incomes can support. That’s the finding from Moody’s proprietary analysis of U.S. housing markets. Among those 392 markets, 149 are overvalued by at least 25%.

“Now that home prices have become ‘overvalued’ we’re set to enter into a period where both income growth and inflation outpace home price growth, says Zand. For home shoppers who’ve been priced out by the pandemic’s housing boom—which saw U.S. home prices soar 34.4% since February 2020—that sounds a lot like a “peak.”.

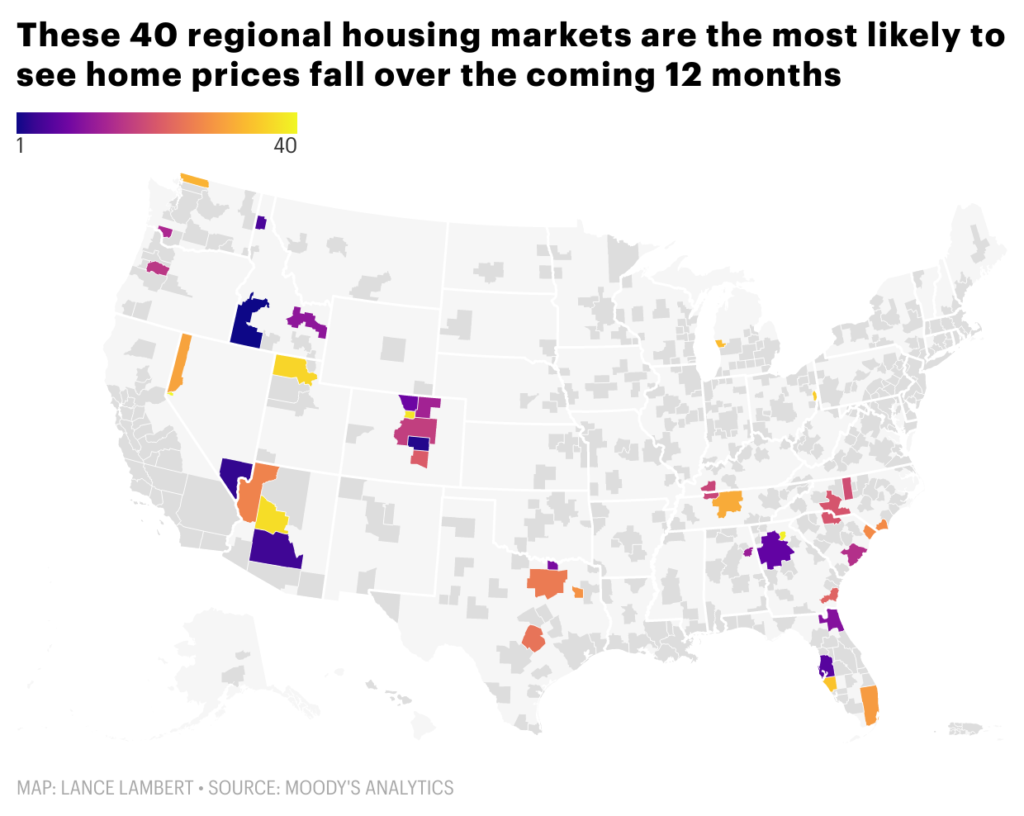

Zandi says the extremely “overvalued” housing markets like Boise, ID (73% overvalued?!) and Phoenix, AZ are at the highest risk of falling home prices over the coming year, with a possible 20% decline. . So are numerous markets throughout the Mountain West, Southwest, old South, Carolinas, Florida, and Texas.

But hold up, this is the national scene. Let’s look at this map of the areas that are most likely to see prices drop. Southern California is not white, but it is gray, so maybe it’s not that bad.

THE CALIFORNIA HOUSING MARKET

Whether you’re a professional real estate investor or just a casual observer dreaming of someday nabbing that dream home, just about everyone has noticed that home prices have skyrocketed since the Covid-19 pandemic hit. A housing market slump looked all but assured in 2020 as strict state-issued lockdowns pushed the U.S. unemployment rate to its highest level since the Great Depression era, and many states had banned in-person home showings. However, prices certainly didn’t slump. Although very few saw it coming, in retrospect, it shouldn’t be surprising. What happened was, a vicious circle was started that created a home price elevator to the top. It all started with the lockdown and accompanying panic, people were scared to leave their home, and they certainly weren’t about to let hoards of strangers come into their house mask gloves booties or not. So folks that normally would have moved stayed put. That caused the housing inventory shrank dramatically. You know the laws of economics, it’s supply and demand. When supply drops or demand rises, prices rise.

Three years after the scary part of the pandemic has passed and people are moving about freely and unmasked we still have a low inventory. Why? Because with such a low supply, people who normally would have moved are staying put because while they know they can sell their home quickly, they’re afraid they won’t be able to find their next home and they’ll end up living in a hotel room somewhere. Where there are many realtors and lenders like me who have come up with solutions to this concern, perception is reality and the inventory has stayed low because so many are hunkering down. Add in the fact that interest rates have risen by a large percentage and that has turned off many other potential buyers. The interesting thing about that is that rates are still historically low, but again perception is reality and news outlets know full well that “end of the world” stories get the highest ratings, not the cloud’s silver lining.

What about demand? That’s gone up too, and the reason may surprise you. “We’ve been in a strong seller’s market for some time now because of a shift in the mindset of millennials regarding homeownership. Millennials used to be the enemy of real estate, but now they are the largest consumer, comprising 43% of buyers in today’s market.” explains Rogers Healy, owner and CEO of The Rogers Healy Companies in Dallas, TX. “The decision millennials have collectively made to turn away from rental properties and own real estate shifted the market completely.” And another thing, how about that stock market? Did you know that stocks have lost 20% on average this year? And “sure-thing up & comer” Netflix went from 710 to 120 a share with other techie stocks crashing s well. And the odd thing is that while bonds normally go up when stocks go down, they are also going down this time. So the senior market, with so much of their retirement nest eggs in mutual funds, have just lost 20% of their retirement so they’re not about to take any chances moving. (On a side note, I’ve been saying “invest in real estate” for years, and lookie here, stocks bonds dropping and real estate rising…)

So prices have been going up, up and UP until now they have reached all-time highs. But we all know this can’t last forever, can it? So the BIG Question on everyone’s mind right now is, “have prices reached their peak”? The easy answer is YES, but hold up. If you asked people last year if they were at their peak, most would have said yes… and then prices rose another 20%! So maybe we should see what the “experts” have to say.

Let’s start with the national scene. Moody’s Analytics chief economist Mark Zandi is ready to call it. He told Fortune magazine in June that “The housing market has peaked…everything points to a rolling over of the housing market. Housing demand is coming down fast. Home price growth [will] go flat here pretty quickly; we will see [home] price declines in a significant number of markets.” Unlike a stock market correction, which means a greater than 10% drop in equities, Zandi says a “housing correction” means the end of a housing boom and the beginning of a period where home prices will fall in some regional markets. Over the coming 12 months, he expects year-over-year home price growth overall to be 0%. If that comes true, it would mark the worst 12-month stretch since 2012. It would also be whiplash for real estate agents and brokers who’ve watched home prices soar 19.8% over the past year.

Among the nation’s largest 392 housing markets, 96% have home prices that are “overvalued” relative to what local incomes can support. That’s the finding from Moody’s proprietary analysis of U.S. housing markets. Among those 392 markets, 149 are overvalued by at least 25%.

“Now that home prices have become ‘overvalued’ we’re set to enter into a period where both income growth and inflation outpace home price growth, says Zand. For home shoppers who’ve been priced out by the pandemic’s housing boom—which saw U.S. home prices soar 34.4% since February 2020—that sounds a lot like a “peak.”.

Zandi says the extremely “overvalued” housing markets like Boise, ID (73% overvalued?!) and Phoenix, AZ are at the highest risk of falling home prices over the coming year, with a possible 20% decline. . So are numerous markets throughout the Mountain West, Southwest, old South, Carolinas, Florida, and Texas.

But hold up, this is the national scene. Let’s look at this map of the areas that are most likely to see prices drop. Southern California is not white, but it is gray, so maybe it’s not that bad.

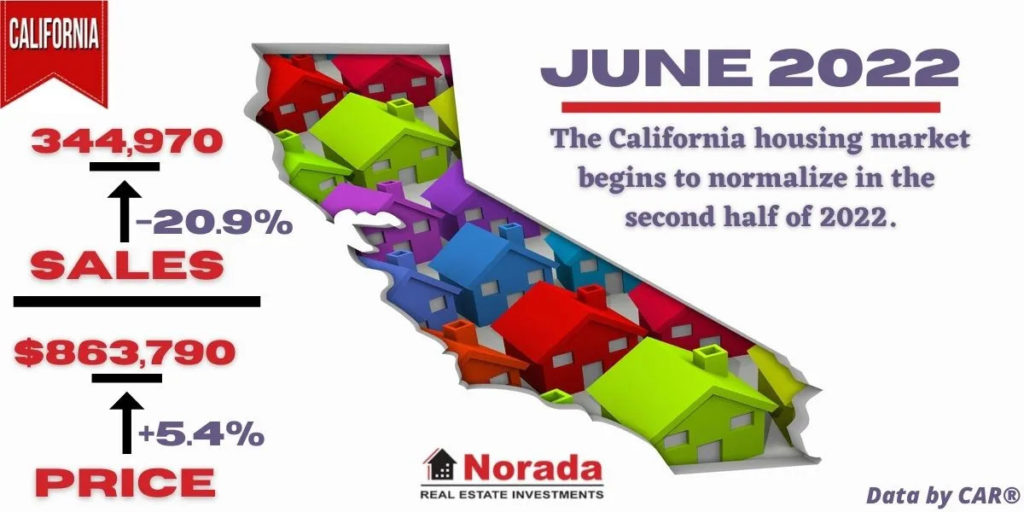

California housing market has started showing signs of a market shift with the rise in interest rates in April and May. If you watched my video on “Inflation & Real Estate” you may remember that when inflation strikes, the government has no choice to raise interest rates, and they plan to do so at least four times this year. The market continued to downshift in June as housing demand cooled further to levels not seen in the past two years and logged its monthly biggest dip since May 2020, according to C.A.R.

Although California’s the median price in June was 5.4 percent higher than the previous June’s, the median home price declined 4.0 percent in June to $863,790 from the revised record-high of $900,170 recorded in May, according to the California Association of Realtors®. After rising for four months in a row, the percentage of million-dollar house sales fell as sales in the higher-priced group fell 8.3 percent from the previous month. This makes sense: With interest rates rising, the hi-end buyers had to look at smaller homes, and there was no one to pick up the slack at the high end.

June’s sales PACE was down 8.4 percent on a monthly basis from 376,560 in May and down 20.9 percent from a year ago when 436,020 homes were sold on an annualized basis.

CAR’s latest weekly housing data for the week ending July 18, 2022 brings some long-awaited good news to homebuyers and prospective buyers:

- While rising interest rates have lowered the purchasing power of purchasers, larger inventories and less competition mean that buyers who remain in the market have a greater chance of having their offer accepted than at any time since the outbreak began. After more than two years of persistent year-over-year reductions in the number of active listings for sale, the inventory shortfall has demonstrated consistent signs of improvement since May 2022.

- There were more active listings on the market in June than at any time over the previous two years. For the week of June 10 there were over 48,000 active listings, surpassing the week of May 23, 2020, as the greatest amount of active listings since we began collecting weekly MLS statistics in 2020. Yes, listings remain down relative to historical norms, but it’s good to see a more steady upward trend this year.

- With the increase in inventory, homebuyers are finding the market to be less frenetic than at any time since the beginning of the epidemic. Last week, 46 percent of closings were for residences that sold for more than the asking amount. This is only the second week since September 2020 in which less than fifty percent of properties sold for more than the asking price, still high but again a trend in favor of buyers.

- In addition, a greater proportion of sellers are ready to decrease their asking price, with 37 percent of current listings reduced from the initial list price last week—another two-plus year high. Combined with a recent decrease in interest rates, which we believe to be temporary, the growing likelihood of locating a property and having an offer accepted should excite buyers currently in the market.

C.A.R. President Otto Catrina states, “California’s housing market continues to moderate from the frenzied levels seen in the past two years, which is creating favorable conditions for buyers who lost offers or sat out during the fiercely competitive market. With interest rates moving sideways in recent weeks and fewer homes now selling above the listing price, prospective buyers have the rare opportunity to see more listings coming onto the market and face less competition that could force them to engage in a bidding war.”

The Los Angeles Times just reported that Southern California region’s six-county median sale price was $750,000, down from $760,000 in May. However, a broader view shows that prices are still soaring compared with last June, when the median price was $679,000. The data, released Tuesday by DQNews, marks the first month since January that Southern California’s ultra-competitive housing market saw a decline in the median home price.

Redfin data indicate that 29.6% of all homes on the market in the Los Angeles metro area had price cuts in June. That’s more than double the 12.6% rate of June 2021 and higher than in dozens of other cities, including San Francisco, Boston, Detroit and St. Louis. Comparing the six counties, Los Angele County’s median price did not change from May to June, while Orange and San Diego Counties dropped the most at 2.8 and 2.9%.

Finally, the number of Home sales dipped slightly from May on a month-over-month basis but plunged compared with a year earlier, DQNews said. A total of 20,289 SoCal homes were sold in June compared with 27,143 the previous June — a decline of 25.3%. That follows a slew of other evidence that the housing market has sharply slowed since mortgage rates jumped this year, rising from the low 3% range to the mid-5% range, where they are now.

So to answer the original question, will the housing market peak in 2022? Did it just Peak in May? In June?

Vincent Chan, CEO of real estate development and investment firm Christina, maintains that the housing market never “peaks.” “It only warms and cools — and sometimes booms — over time, alternating between a buyer’s and seller’s market. But it always keeps going up,” Chan continues. “Think about a hiking trail going up a mountain from the side: Sometimes it gets steeper, sometimes it dips back down, but it always keeps climbing.”

Thanks a lot Mr. Chan, you just ruined by question. So let’s change the question to, “is 2022 good for buyers? For sellers?”

Whether you’re looking to buy or sell, timing your local market is an important part of real estate investing. For sellers in the California housing market, it’s still a good time to sell for sure. Sure you may not get 10 offers in the first day of your listing like 2021, but time s are still good as prices are still near record highs.

But with an increase in inventory, prices and interest rates leveling off and many buyers pausing their searches, right now could be a good time for BUYERS as well. Just make sure to get pre-APPROVED, not pre-qualified – Contact me (licensed Mortgage Loan Originator NMLS# 2246767) and not only will I give you the scoop on your LOCAL market, I will make sure you have the absolute best chance to make YOUR offer the one that is accepted with a “PYT Pre-Approval“ that comes with a $15,000 Guarantee. Even better, my lender will buy the house in cash for you (and then assign it to you during escrow) if that’s what it takes to secure your dream home. Yes, these are uncertain times, but Rock Real Estate continues to provide a wealth of solutions. Where there’s a will, there’s a way. In short, whether you’re selling or buying, in this market it really pays to know your stuff… or hire somebody that does.

THE SOUTHERN CALIFORNIA HOUSING MARKET

The Los Angeles Times just reported that Southern California region’s six-county median sale price was $750,000, down from $760,000 in May. This sounds like good news for buyers. However, prices are still soaring compared with last June, when the median price was $679,000. The data, released Tuesday by DQNews, marks the first month since January that Southern California’s ultra-competitive housing market saw a decline in the median home price.

Redfin data indicate that 29.6% of all homes on the market in the Los Angeles metro area had price cuts in June. That’s more than double the 12.6% rate of June 2021. Comparing the six counties, Los Angeles County’s median price did not change from May to June, while Orange and San Diego Counties dropped the most at 2.8 and 2.9%.

Finally, the number of Home sales dipped slightly from May on a month-over-month basis but plunged compared with a year earlier, DQNews said. That’s bad news for Realtors. A total of 20,289 SoCal homes were sold in June compared with 27,143 the previous June — a decline of 25.3%. That follows a slew of other evidence that the housing market has sharply slowed since mortgage rates jumped this year, rising from the low 3% range to the mid-5% range, where they are at this time (July, 2022).

To Sum Up…

So to answer the original question, will the housing market peak in 2022? Did it just Peak in May? In June?

Vincent Chan, CEO of real estate development and investment firm Christina, maintains that the housing market never “peaks.” “It only warms and cools — and sometimes booms — over time, alternating between a buyer’s and seller’s market. But it always keeps going up,” Chan continues. “Think about a hiking trail going up a mountain from the side: Sometimes it gets steeper, sometimes it dips back down, but it always keeps climbing.”

Thanks a lot Mr. Chan, you just ruined my question. So let’s change the question to, “is 2022 good for buyers? For sellers?”

BOTTOM LINE

Whether you’re looking to buy or sell, timing your LOCAL market is an important part of real estate investing. For SELLERS in the California housing market, it’s still a good time to sell for sure. Sure you may not get 10 offers in the first day of your listing like 2021, but times are still good.

But with an increase in inventory, prices and interest rates leveling off and many buyers pausing their searches, right now could be a good time for BUYERS as well. Just make sure to get pre-APPROVED, not pre-qualified – Contact me (licensed Mortgage Loan Originator NMLS# 2246767) and not only will I give you the scoop on your LOCAL market, I will make sure you have the absolute best chance to make YOUR offer the one that is accepted with a “PYT Pre-Approval“ that comes with a $15,000 Guarantee. Even better, my lender will buy the house in cash for you (and then assign it to you during escrow) if that’s what it takes to secure your dream home. Yes, these are uncertain times, but Rock Real Estate continues to provide a wealth of solutions. Where there’s a will, there’s a way. In short, whether you’re selling or buying, in this market it really pays to know your stuff… or hire somebody that does.

Recent Comments