As the curtain fell on the historic real estate year 2021, inflation suddenly reared its ugly head. With the highest inflation rate since spandex-clad Hairbands roamed the earth in the late 20th Century, many homeowners and real estate investors are wondering what this means for them and their most important asset: their property. The effect of inflation can be easy to spot in consumer goods – how about that cost of gas, huh? – but what effect does inflation have on real estate?

Well, unlike the price of milk, the effects on real estate are a lot more complex. Let’s take a closer look at the role of inflation on real estate assets, mortgages, and how home buyers, sellers and investors should position themselves in a high-inflation environment.

What is inflation?

Inflation refers to a decrease in the purchasing power of money, reflected in an increase of the price of goods and services in the economy. So, as inflation ticks up, every dollar you earn loses value and therefore impacts your ability to spend.

While the housing market was already seeing short supply and high demand before 2020, it is safe to say that the pandemic’s arrival exacerbated these trends. Many renters entered the housing market in search of a home of their own, while plenty of homeowners sought opportunities to trade up and increase their space. As this increasing demand took shape, we saw many existing homeowners staying put, therefore limiting the supply of available properties. The resulting housing market inflation amounts to a basic case of supply and demand at work, adding fuel to an already raging fire. And now as 2022 begins, it appears that inflation has hit the entire economy, not just the housing market. So let’s take a deep dive into the swamp and see what this all means for you, the property owner.

Inflation can Lead to Higher Mortgage Rates

Generally speaking, as inflation increases, so too do interest rates. That’s mainly because as inflation goes up, central banks typically raise short-term rates to put downward pressure on the inflationary environment.

If interest rates are low, as they have been, more consumers tend to borrow which means they have more money to spend. This eventually moves inflation higher. So central banks raise interest rates to fight off inflation, believing that consumers will tend to save more rather than spend because returns from higher interest rates are more appealing. The hope is that with less consumer consumption, inflation will ease.

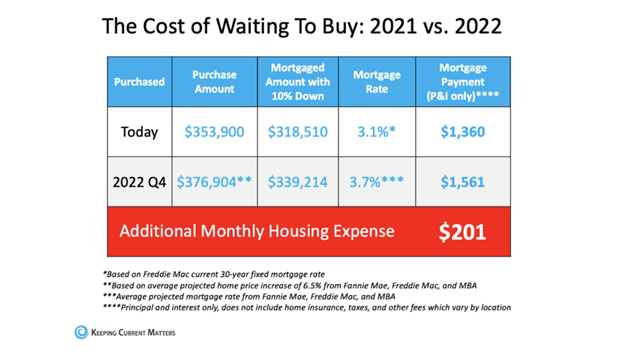

In late-breaking news, Freddie Mac just announced that mortgage rates have jumped by nearly 0.5% in the first two weeks of the year. And this is without any change in interest rates by The Fed. It seems pretty clear that the all-time low interest rate seen in January of 2021 is a thing of the past.

Most experts say that rates are likely to continue moving higher as the market adjusts to two new realities:

(1) Decades-High Inflation: inflation is currently at the highest level in four decades. Higher inflation means higher interest rates. That’s because bond investors need to charge higher interest rates to compensate themselves for their investment losing value relative to the inflation rate. For example, if interest rates are 3% and inflation is only 2%, investors are making a positive return on their investment (3% interest rate – 2% inflation = 1% positive return). But if inflation goes up to 6%, the investors’ rate of return turns negative (3% interest rate – 6% inflation = 3% negative return). If inflation stays elevated, it’s very likely that interest rates will continue to move higher.

(2) The End (and possible Reversal) of the Fed’s Pandemic-era Economic Stimulus Programs: the Fed has injected a staggering $4.6 trillion into the economy since March 2020. In November 2021 the Fed hinted that there might be several hikes in interest rates in 2022, and in recent weeks suggested that it will end its stimulus programs in early 2022, and start “shrinking its balance sheet” shortly thereafter. This means Fed may start to unload its massive bond holdings into the market, which would drive up bond supply, and interest rates, in the months ahead.

Bottom line: An inflationary environment usually sees higher mortgage rates.

Inflation can lead to Higher Real Estate Prices

Generally speaking, when inflation increases then housing and other real estate asset prices follow suit. That said, we also see mortgage rates rise, which tends to put downward pressure on demand for real estate because debt becomes more expensive. Less demand means lower prices. What makes 2022 different is that the inventory of homes for sale is still near all-time lows, so even if demand falls, that downward pressure may not be felt much if at all.

Bottom line: An inflationary environment has an unpredictable effect on prices as some factors will lower values while others raise them. Let’s dig into the weeds for some of the subtleties.

And now for The Good, The Bad and the Ugly … as in Ugly Houses!

Good news for Homeowners and many Real Estate Investors

Have you heard the term “Good Debt”? Well, inflation can be good news for anybody holding debt, such as a mortgage or construction loan. (For those who paid cash, sorry.) Your existing debt becomes cheaper as inflation increases. If you bought or refinanced at 3% and inflation historically is also 3%, then you can look at it as cost-free money. If inflation is 6%, the cost of your debt is even less. Consider the following example:

5 years ago you bought a property for $125,000 with a $25,000 down payment. You have a 25-year $100,000 mortgage at a 3% fixed interest rate. Assume that inflation increases 3% every year following. Each following year you’re still only paying $475/month, but the value of your asset has gone up 3% every year. Therefore, the relative cost of your debt goes down every time inflation hits.

Bad News for Flippers/Rehabbers

Because things get more expensive with inflation, the cost of materials used in construction will also rise. And inflation not only boosts machinery costs and building materials but also the cost of labor. It also puts developers and investors in a scenario where cost-overruns are much more possible. Thus if you believe that inflation is here to stay awhile, it would be wise to factor in cost increases into your calculations.

Good news for Homeowners and Residential Real Estate Investors

The good news for investors with single-family homes, condos, and multifamily in their portfolios is that these asset classes tend to outperform other investments classes in inflationary environments.

The Wall Street Journal reported that “Owners of residential and commercial real estate are often better off during times of rapid inflation than owners of stocks or bonds. Office, retail and apartment rents are typically tied to consumer prices and rise with inflation, pushing up property income. Inflation also makes construction more expensive, which benefits existing property owners because they can expect less competition from new buildings.” I would add that Covid has added a new wrinkle in that office space is in less demand as more people work from home, so residential real estate seems like the best bet – after all, EVERYBODY needs a place to live, right?

Bad News for Renters and Landlords in Rent-Controlled areas

Studies have shown that historically high periods of inflation also saw a similar increase in rent prices, which makes sense.

But Buy & hold investors have to be on their toes during inflationary times. If a landlord doesn’t raise rents to match the rate of inflation, they are taking a loss that is compounded over time. And the Draconian Covid-related anti-landlord measures taken by the government, especially the state of California and County and City of Los Angeles, remind investors that the government can have a powerful role in all this. Aside from preventing landlords from evicting non-paying tenants, those areas with rent control typically limit the amount that a landlord can increase the rent. 3% per year is a common rate increase maximum. Thus if inflation rises to 6%, a 3% rent increase still leaves landlords taking a hit to their ROI which is compounded over time.

Good News for Anyone Owning Real Estate

Given that under most circumstances an inflationary environment leads to higher rents and higher asset prices, real estate is considered to be a great hedge against inflation. Remember the three positives we outlined earlier:

- The value of your property rises with inflation,

- The debt on your asset is devalued as the value of that debt decreases with inflation,

- (and for landlords) Rents rise with inflation.

That said, real estate investors still need to be careful in high-inflation environments, primarily because the cost of borrowing will increase, putting downward pressure on your cash flow and demand for real estate if you want to liquidate. Flippers suffer a double whammy, as construction costs soar while buyer demand weakens.

For HOMEOWNERS who are moving, as I always say, “If you’re selling one home and buying another, whether the prices are high or low it ends up being a wash, while it’s the interest rate on the new home that really matters.”

For Real Estate INVESTORS currently owning Real Estate, Inflation is generally a good thing as long as you remember to increase your rent to keep pace with the inflation rate.

For Prospective INVESTORS, the circumstances for prospective investors in an inflationary market are very different from those for existing owners. With that reality in mind, the most important factor this group must consider is timing. How long do you plan to own the prospective property? If you are in it for the long haul, you should expect the same value increases that existing owners are experiencing. But if you are a flipper/rehabber, then you need to extra cautious. One of the dangers of short-term investing in an inflationary real estate market is the risk of getting caught in a real estate bubble. New home buyers should expect closing costs to run as high as 6 percent of the home price, and if you do not possess enough equity to absorb those costs, then you may find yourself at risk of losing money when the bubble bursts. For all investors, an inflationary environment can be positive if they make smart acquisitions – “The profit is made at the purchase” – and stress test their portfolio against inflationary pressures such as rising interest rates.

One last comment: I’ve been hearing from a number of homeowners that they are waiting to move until the prices come down. As you now know, this is probably a bad strategy as it is extremely likely that interest rates will continue to rise. Right NOW you have the best of both worlds, low rates and high selling prices. Don’t miss out on this opportunity to move or do a cash-out refinance, as cash may never be this cheap again. Don’t let your equity just sit there collecting the proverbial dust, when you can have money to spend – perhaps invest in real estate – at just 3% interest. Just sayin’…

Recent Comments