The window of opportunity for buyers to be in control to buy a home is rapidly closing. Let’s find out what this means for you if you’re thinking of buying or planning to sell a home.

We are seeing sellers start to take back control of the housing market here in Southern California as home prices stabilize and inventory levels continue to remain very low, so let’s dive into exactly how much along with why this is happening. Inflation continues to fall keeping mortgage rates steady. In fact, mortgage rates have fallen from their high of over 7% three months ago and are hovering around 6% as of today (February 8, 2023). Redfin just published an article on February 2nd showing that rates have just dipped below 6% so they are at the lowest rate since September. IF you’re a buyer, you may be saying, “mortgage rates are going down, this is great!” But hold on there partner. If the mortgage rates continue to dip, thousands of buyers will come back into the market, and what does that mean? More demand, and THAT means back to a Sellers’ Market. I’ve been saying there’s a window of opportunity to buy a home here in Los Angeles and throughout Southern California up through Spring and that window is starting to close. Bottom line buyers, don’t stay out of the market because you think the rates are high now and will drop soon. That’s only HALF of the equation, as I will explain. And if the rates do drop, you can re-finance. But you’ll have bought your dream home will already be enjoying it.

Now if you’re planning to SELL a home, I’ll be covering exactly what you need to do to get your home sold in today’s real estate market later in this article.

All right, let’s take a real quick look at what is happening nationally, which is driving the Southern California housing market locally. Inflation fell again this past month to 6.5%. That’s down about 1 ½% in the past 3 months. This is helping mortgage rates stay steady, which are affected by inflation as I’ve explained to you before. Mortgage rates have remained in the low 6% range for the past 3 months now thanks to easing inflation concerns. If inflation holds steady or continues to drop over the coming months, mortgage rates could fall into the 5s. As I mentioned a minute ago they’ve just crossed the 6% line. The fears of interest rates hitting 8-10% seem to be well behind us now. But listen, if mortgage rates do fall or even just stop rising, this may unleash the pent-up demand that has been lingering in the housing markets and drive us BACK into a sellers market in the Spring and Summer selling season. Buyers, do you remember that? Nobody would even talk to you unless you bid over listing price, and then you had to bid against other sellers and hope you won out.

Let’s dive into what is happening here in the SOUTHERN CALIFORNIA housing market. A big reason for this pent-up demand is coming from MILLENIALS. As a group, Millennials delayed getting married and starting families and as a result their home buying. But now they’re getting married, having babies, and realizing they need to buy a home or move-up into a bigger home. Now these Millenials are shopping for homes creating more demand. Here is the problem though. Many Sellers are essentially locked into their homes because so many either purchased or re-financed into 3% interest rates over the past 2-3 years. If they move now, then they’re signing up for a 6% interest rate and much higher monthly payments than what they are paying now. This is causing inventory levels to remain flat. The confluence of these two events, more millennial buyers (more demand), and fewer people selling (less supply) could likely cause home prices to stabilize or even start rising again soon. We could shift rapidly from the balanced market that we’re in now to a sellers market.

Los Angeles and Southern California Real Estate Market

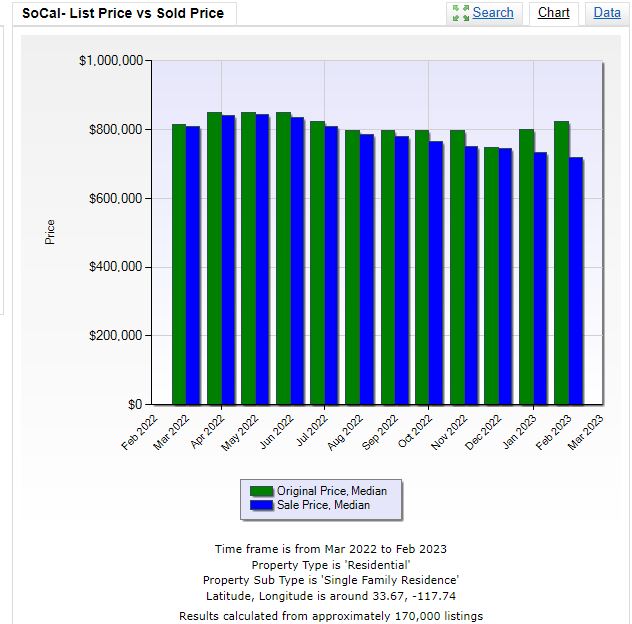

Let’s look at some stats: Housing prices for a single family home in Southern California have been gradually falling since their peak in May of 2022 and the median price is just about $750,000, although sellers are listing around $810,000. Right now, they’re probably not going to sell at listing price. In the San Fernando Valley and Eastern Ventura County, prices have been essentially the same since September of 2022 at a whopping $1,000,000 for a single family home, and folks are listing their homes at just over $1.2 Million.

Inventory of homes has been rising every so slightly for the past year to month to about 25 days, which is incredibly low but about double what we had last year at this time. Homes are taking longer to sell these days, and we’re averaging 35 Days on Market. This shows us that homes on average are taking on average of more than twice as long as last year to sell. Compared to last month, the days on market rose by 6 days from 28 to 34 Days. So homes are taking a longer to sell here which is consistent with what is happening around the country.

This is a great chart (below), note how days on market down to less than a week in early 2021 and are now SIX TIMES longer, but since then the prices have NOT dropped.

Now, this is what the data is telling us, but the data does lag behind the reality on the ground. I’m starting to see first hand that buyer competition for homes is heating up. I just sold a townhome in Northridge California that I had to file a lawsuit to evict the tenant and the owner was crying because he thought we’d have to lower the selling price and he’d take a big hit from when we had first tried to sell it in the Summer of ’22 before we had to take the tenant to court. But after doing my research I came to the conclusion that I should keep the the listing price the same, and sure enough we sold it in just over a week at full price and both the seller and buyer were happy. That’s what I like to see. So if a home is priced really well and is in a desirable area, it’s still moving in 1-2 weeks, but many other homes are taking much longer to sell because the sellers are not tracking the market. And the other big data point I like to look at is the Final Sales to List Price Percentage. This tells us how much above or below the List Price that homes, on average, sold for. So homes sold for 97% of list price. That means that on average, homes had to drop their price by 3% in order to get sold.. During the pandemic, we were seeing average sales to list prices usually from 102-107%. Now, 98% is considered a balanced market. Below this it is indicating a buyers market, and above it, it’s indicating a sellers market. As you can see, we are somewhere between a balanced and a buyer’s market right now.

Right NOW May be a Golden Opportunity for Buyers

So… What does this mean for you if you’re thinking of BUYING a home? If you’re thinking of buying, I think there ‘s still a window to get credits and maybe price reductions, though I’d focus on the credits. That window is really starting to close in most markets. Before rates lower, I would expect the next 2-3 months to be prime buying season for a buyer. It appears we are on track for a shift back into a seller’s market as inventory remains extremely low and pent-up demand starts to unleash in the Spring and Summer, as it does every year. At the moment, buyers can also shop around and find the house they really want. Why is that? Well there are four reasons. If you’re looking to buy a home you have 1) higher inventory levels than a year ago giving you more options to choose from 2) Lower competition from other buyers due to the recent higher mortgage rates, 3) opportunity to get seller credits to cover closing costs and buy down interest rates, and 4) being able to buy at 10% off of where prices were 6-9 months ago. The downside is that rates are comparatively high, but that can be re-financed out in 6-12 months if rates do drop. Now one thing that could throw a monkey wrench into this is if the tech layoffs that have been on the rise lately continue and begin impacting the overall economy, so we will be paying attention to the job market.

With inflation dropping, mortgage rates have stabilized again around 6%, which is down over a full percent from the high about 3 months ago. This is in line with what I’ve been predicting that mortgage rates will drop once inflation drops. If inflation continues to fall over the next few months, it’s conceivable to see rates back in the mid 4% to 5% range. If rates do drop into the 4-5% range, get ready for a lot more buyers, especially those millennial buyers to enter the market again. However, I wouldn’t anticipate that prices will suddenly spike back up. I think we’ll see a more normal market of some homes selling over, and some under depending on how good of a home it is.

Strategies for Sellers

So what does all this mean if you’re planning to SELL a home in the next few months? Despite the shifting winds in the housing market with more buying activity picking up, it’s still very important to price your home ahead of the market, meaning lower than you would like to. This is going to drive more interest for your home online. This will in turn result in more showing, and more offers. The goal is to get at least two offers or more which will allow you to drive the sale price up higher. But even if you do end up with multiple offers, be prepared to give credits to buyers to help buy down interest rates to make the home more affordable. Buyers need the interest rate buydowns to be able to purchase right now. It’s also more important than ever to make sure your home is properly prepared to sell. This can include things like painting the exterior and/or interior to brighten the home give it a neutral color, pressure washing, replacing carpets or carpet cleaning. If you are wanting to get an idea of what your home may sell for and what it should be priced at contact me and I’ll run a no-obligation home value for you.

That’s a complete overview of the housing market here in Southern California. I’ll show you the myriad of selling options we have, from online auctions to “fix now, pay later” to having my lender buy your house in cash now and letting you stay there until you find your new home. Leave a comment here or email me back and let me know what you thought, and I’ll see you on our next video right on the Rock Real Estate Youtube channel.

Recent Comments