As you saw in our previous article and video, 2021 was a Real Estate Year for the Record Books, with no less than eleven (11) records being set. Naturally, homeowners, potential sellers and buyers are wondering what the future holds – will the insanity continue or will things make sense again… or something in-between? Here are the Top Five Questions that Real Estate Professionals are being asked as 2022 begins.

1. IS THE HOUSING MARKET GOING TO CRASH IN 2022?

Rumors of a “housing crash” have been murmured for years. But is there actually meat behind those murmurs or are they just clickbait?

The truth is, while most news outlets feed off the doom and gloom of housing crash headlines, you can feed them a different story: the facts.

Yes, the escalation of home price appreciation leaves many to wonder if this is a bubble that’s going to burst. But the truth is, the housing market looks very different from the infamous events that led to 2008.

For instance:

- Rising home appreciation is a direct result of low supply and high buyer demand

- Mortgage lending standards are much tighter than they were in 2008

- The Secondary Mortgage Market is no longer filled with subprime loans that were ticking time bombs

- Homeowners are using their equity much more responsibly today

2. WILL THERE BE A WAVE OF FORECLOSURES AS FORBEARANCE ENDS?

There’s no sugarcoating it. The pandemic was hard on a lot of Americans, leaving many jobless and without a choice but to put their mortgages in forbearance.

And as forbearance comes to a close, many are wondering: is a wave of foreclosures on the horizon?

The answer you can tell your clients is a sound “no.”

Here’s why according to experts:

- There are far fewer homeowners in trouble this time

- Most of the mortgages in forbearance have enough equity to sell, rather than foreclose, on their homes. Thanks to the current high price of real estate, homes are not “underwater” (worth less than their mortgage loans) as they were then, meaning that a homeowner in financial trouble can simply sell their home to avoid foreclosure and still come away with cash in hand.

- The current low inventory market can absorb listings – in fact, it needs them

- The government learned lessons on how to prevent foreclosures

Today, the probable number of foreclosures coming out of the forbearance program is nowhere near the number of foreclosures that impacted the housing crash.

To give some perspective, according to the Wall Street Journal:

“Between 2006 and 2014, about 9.3 million households went through foreclosure, gave up their home to a lender or sold in a distressed sale.” This time, we’re talking about just a few hundred thousand mortgages potentially in that situation, thanks to the forbearance plan.

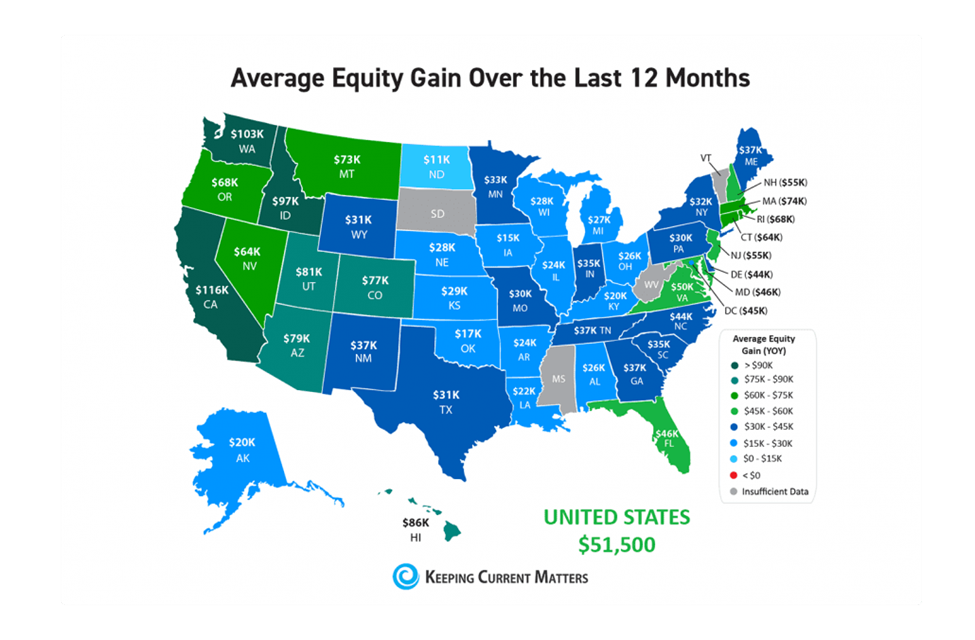

Californians rejoice! We had the largest equity of any place in the entire USA in 2021, OVER DOUBLE the National Average! That means there are almost no homes left in an “underwater” condition, and THAT means that almost all defaulting homeowners can avoid foreclosure – even if all other remedies fail – by simply selling the property.

3. IS THE REAL ESTATE MARKET GOING TO LAST?

As the saying goes: what goes up must come down, right?

In the last year and a half, we’ve seen what could be the hottest real estate market of our lifetime. But we can all agree, or hope with some level of confidence, that the factors leading up to that market won’t be repeating themselves anytime soon.

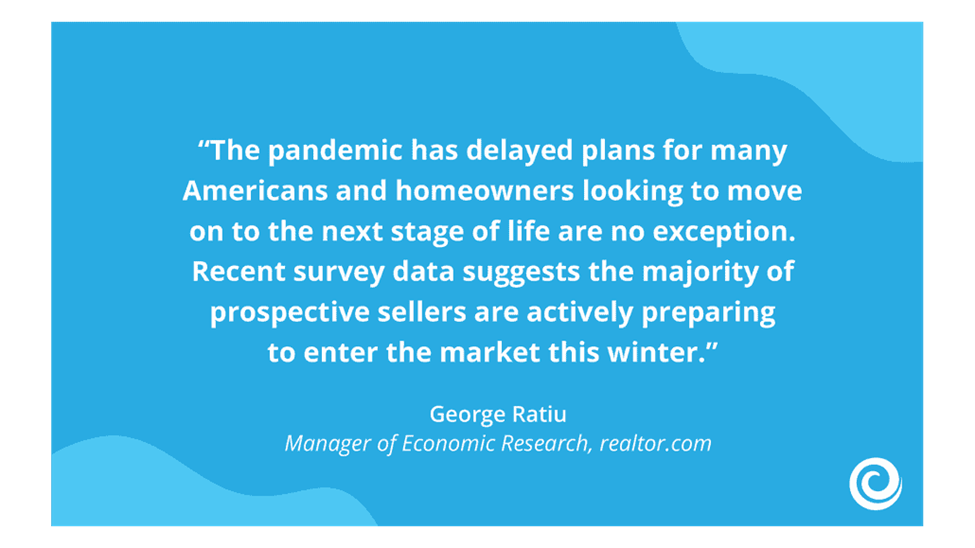

While mortgage rates are projected to rise and home prices continue to appreciate (although at a slower pace next year), we’re still seeing strong buyer demand. Plus, a recent study by Realtor.com shows the majority of active sellers are planning to list their homes this winter.

Much of this motivation to sell stems from homeowners earning record-breaking amounts of equity over the past year at the same time homeownership needs have changed drastically as we moved through the health crisis.

All of these signs point to a real estate market that won’t be cooling off anytime soon.

What we can expect to see is more choices for buyers as inventory rises.

4. WITH PRICES SO HIGH, ARE HOMES STILL AFFORDABLE?

Home values appreciated by almost 20% nationwide over the past year. Let that sink in a minute.

And with mortgage rates on the rise, many people are wondering: is it still affordable to buy a home?

The answer is: YES.

Let’s breakdown why:

- Despite escalating prices, homes are still more affordable than they were at anytime leading up to the housing crisis

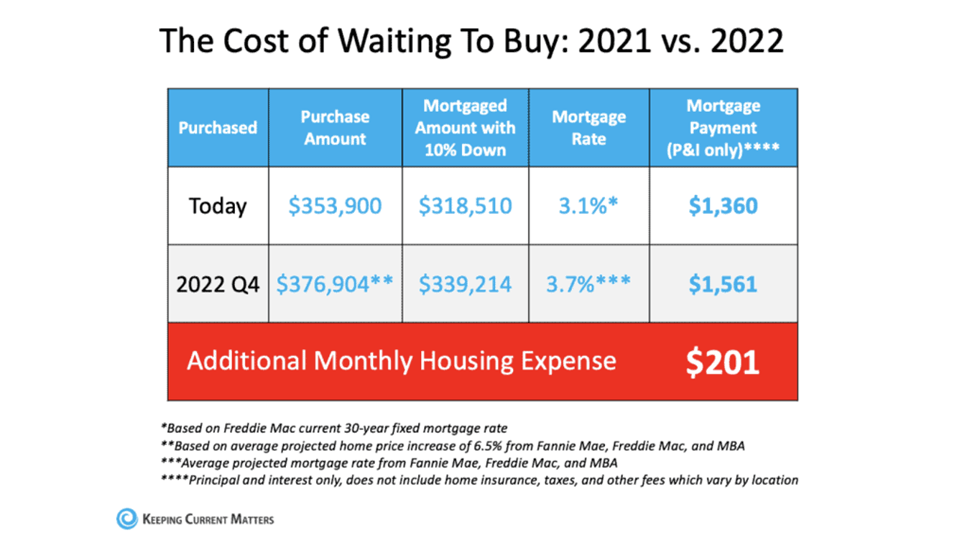

- Homeowners who are moving (i.e. selling their current home to purchase a new one) will sell their current homes for more than then ever could have before. However, if you’re think of moving, there is a risk of waiting too long to pull the trigger

- Rental prices are on the rise, making homeownership a more affordable option in many markets

- Inventory is expected to rise, taking the edge off of the supply and demand issue that led to the price growth we saw over the last year

- While the days of sub-3% mortgage rates we saw in January of 2021 (the all-time record low) may be fading, buyers can remain confident in today’s affordability. Mortgage Rates are still close to all-time lows, meaning that for your monthly payments will be lower if you refinance or purchase for the length of the loan. If you’re planning on keep your current or next home for a long time, you probably will never re-fi again, and the lower rates could add up to huge savings.

5. WHAT WILL HAPPEN WITH THE 2022 MARKET?

If we’ve learned anything over the past couple of years, it’s that we can’t predict the future.

We can, however, project it based on what the experts are saying.

With industry experts anticipating more inventory, higher mortgage rates, and continued price appreciation in the New Year, there’s plenty of incentive for buyers and sellers to make a move sooner than later this year.

Bottom Line: As mortgage rates rise and home prices continue to appreciate, waiting to make a move will mean only one thing: it will cost more to buy a home.

Looking for more detailed information? Look out for our next article/video, the 2022 housing market forecast.

Recent Comments